Health care stocks offer a prescription for uncertain times

With persistent inflation and high interest rates stoking fears of an impending recession, investors are flocking to defensive stocks that can weather economic storms[1] – and health care businesses are arguably the most resilient of all.

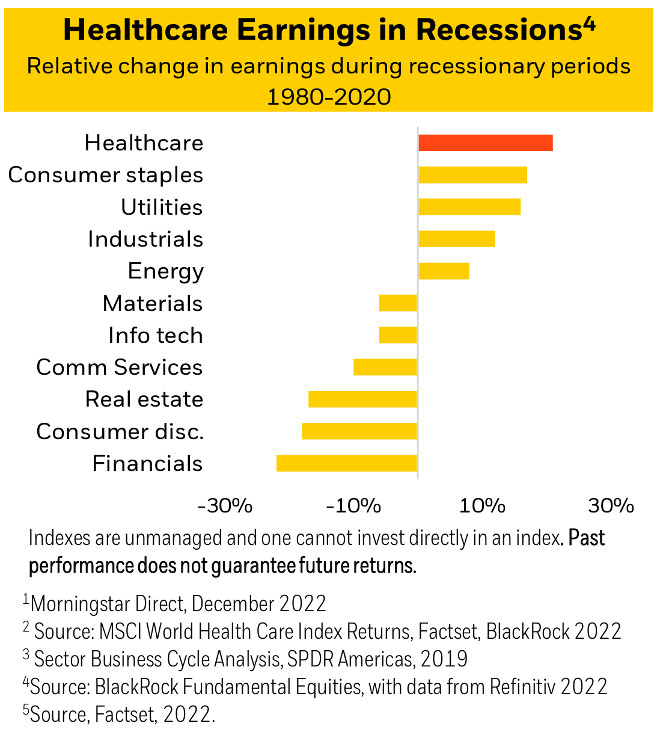

Companies in the sector have shown more robust earnings during downturns than those of any other major industry, including defensive favourites such as utilities and consumer staples. Health care is now also getting a boost from the growing spend on health, wellness and vaccines in the wake of the pandemic and as a result of fast-aging populations in many major economies.

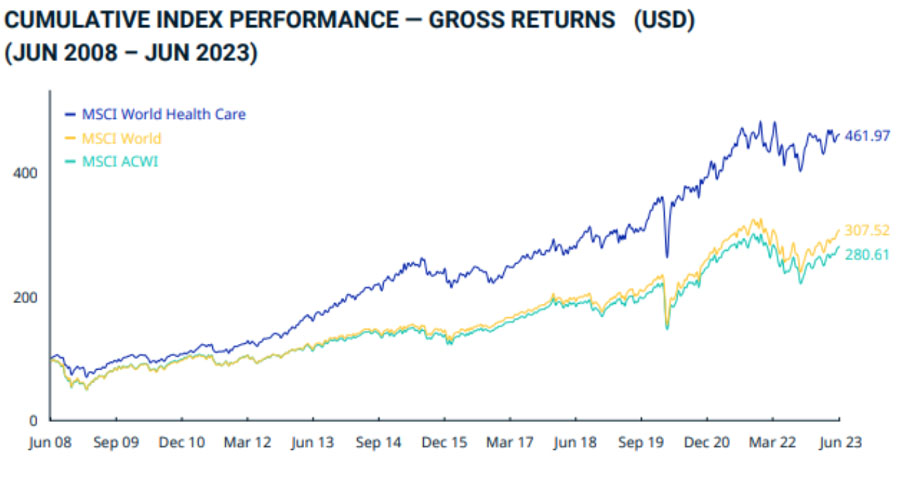

Accordingly, the MSCI World Health Care index had as of 30 June this year achieved a 50% greater gross return in US dollar terms than the MSCI World index since June 2008.[2]

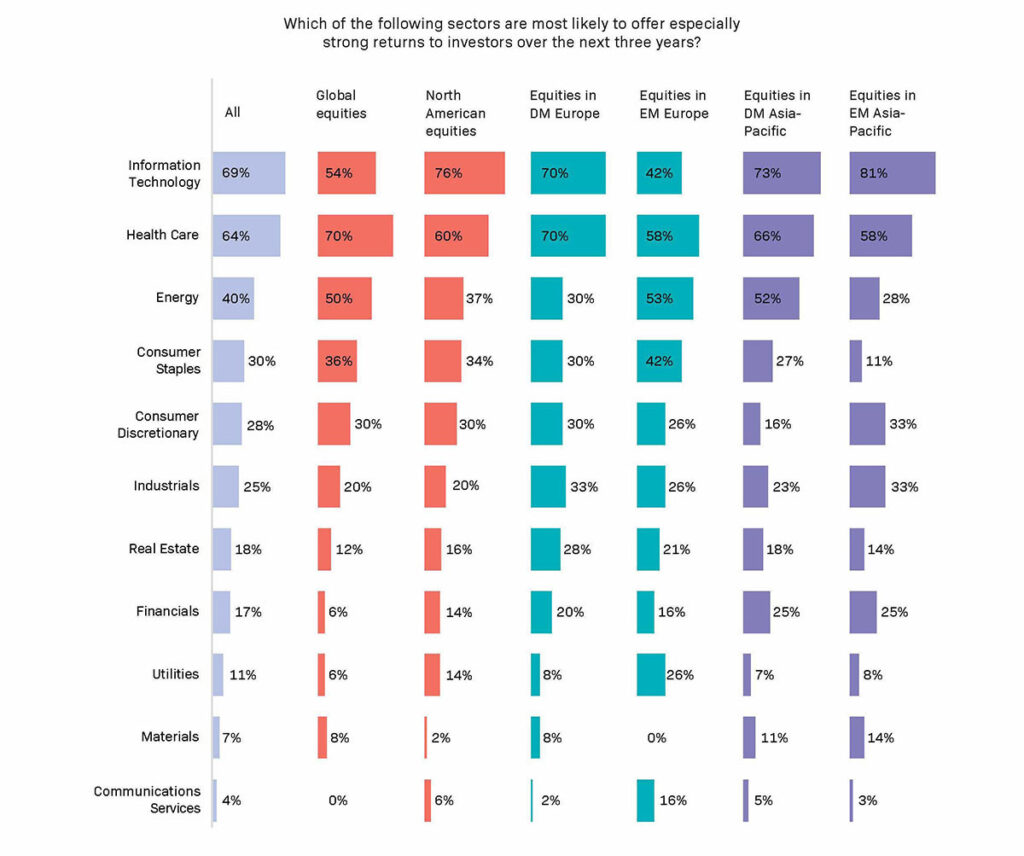

As a consequence, 64% of investment decision-makers at global financial institutions expect health care stocks to deliver strong returns over the next three years, according to an investor survey commissioned by EquitiesFirst and carried out by Institutional Investor.

This wide-ranging study provides insight into how over 300 investors – including asset managers, foundations, pension schemes and endowments – are responding to dramatic shifts in the macroeconomic and geopolitical environment.

Bright outlook for health care

The only sector inspiring greater investor optimism than health care is technology, the report shows. Meanwhile, there is scant enthusiasm for industries more susceptible to high interest rates and slowing economic growth – notably real estate and finance.

There are reasons behind this optimism. The structural factors driving health care’s past outperformance remain firmly in place. If anything, populations are aging even faster, and health care spending in developing countries looks set to accelerate given the rapid growth of their middle classes, especially in Asia.[3]

The Covid-19 pandemic also helped accelerate technological advances in medical devices and drugs, with researchers now exploring the use of mRNA vaccines for a variety of other diseases.[4] As more treatments are developed for thousands of previously untreatable diseases, health care spending can be expected to increase further.

This trend could blur the lines between the two categories where investors tend to place health care stocks. On one side are pharmaceuticals, managed care and medical equipment suppliers, which are regarded as steady defensive plays. Meanwhile, the likes of biotech firms and AI-based health care providers are seen as high-growth stocks that traditionally fare badly when interest rates are high.

Technology has changed the game

That dichotomy may no longer be relevant, however, as emerging technologies transform everything from drug development to patient care.[5]

Advances in 3D printing have paved the way for customisable treatments;[6] robots and less invasive techniques are revolutionising surgery;[7] and AI and cloud computing is powering telehealth services in low-income countries and remote locations.[8]

What’s more, innovations in diagnostics and emerging life-science tools are making it possible to identify diseases at an earlier stage, while big data and analytics are supporting the push to prioritise preventative health care.

Investors must, however, be alert to headwinds facing the sector.

Not least of these is that governments will scale back health care spending following bumper outlays during the pandemic. There are also growing questions over how medical and medtech companies can access patient data to run their business models or create new products amid rising concerns over the need to maintain the privacy of sensitive information.

What’s more, governments are working on market reforms to make drugs more affordable, which could eat into pharmaceutical companies’ profit margins. The realignment of global supply chains as a result of geopolitical shifts could also drive up drugmakers’ costs.

A selective approach to investing can therefore be beneficial, and there is no lack of choice when it comes to health care sub-sectors and themes. As well as defensive strategies focusing on established players, investors can choose from the dizzying array of small-cap and private companies that are working on emerging technologies and novel use cases.

For equities investors looking to boost returns by going global – another finding from the EquitiesFirst x Institutional Investor study – the MSCI World Health Care index contains 142 large- and mid-cap constituents from 23 countries.

While health care may be seen as a defensive sector, it is also extremely dynamic, characterized by rapid innovation and a fast-changing regulatory landscape. Investors must be prepared to manage their portfolios and adapt quickly to a shifting industry and environment.

One way to do that is by accessing securities-backed financing. By using their securities or digital assets as collateral, long-term investors can obtain relatively stable, cost-effective capital with no restrictions on the use of proceeds, including equity investments in new health care themes or technologies. Given how fast these opportunities evolve, this kind of flexible funding can be a valuable tool for investors looking to preserve and grow their wealth during tumultuous times.

[1] https://www.wsj.com/articles/investors-flock-to-safety-plays-but-stock-fomo-lingers-f821acbd

[2] https://www.msci.com/documents/10199/c41a73d1-9037-4dbd-a175-703d3bb77ae6

[3] https://www.bloomberg.com/news/articles/2021-09-02/more-than-1-billion-asians-will-join-global-middle-class-by-2030

[4] https://www.nature.com/articles/s41591-021-01393-8#:~:text=mRNA%20can%20be%20engineered%20not,related%20to%20the%20immune%20system.

[5] https://www.alliancebernstein.com/corporate/en/insights/investment-insights/redefining-offense-and-defense-in-equities-the-evolution-of-technology-and-healthcare.html

[6] https://pubmed.ncbi.nlm.nih.gov/30767736/

[7] https://www.mayoclinic.org/tests-procedures/robotic-surgery/about/pac-20394974

[8] https://www.ft.com/content/cdc166d4-6845-11ea-a6ac-9122541af204

Disclaimer

Past performance does not guarantee future returns, and individual returns are not guaranteed or warranted.

This Document is intended solely for accredited investors, sophisticated investors, professional investors, or otherwise qualified investors, as may be required by law or otherwise, and it is not intended for, and should not be used by, persons who do not meet the relevant requirements. The content provided herein is for informational purposes only and is general in nature and not targeted to any specific objective or financial need. The views and opinions expressed in this Document have been prepared by third parties and do not necessarily reflect the views and opinions of EquitiesFirst. EquitiesFirst has not independently examined or verified the information provided herein, and no representation is made that it is accurate or complete. Opinions and information herein are subject to change without notice. The content provided does not constitute an offer to sell (or solicitation of an offer to purchase) any securities, investments, or any financial products (“Offer”). Any such Offer shall only be made through a relevant offering or other documentation which sets forth its material terms and conditions. Nothing contained in this Document shall constitute a recommendation, solicitation, invitation, inducement, promotion, or offer for the purchase or sale of any investment product by Equities First Holdings, LLC or its subsidiaries (collectively, “EquitiesFirst”), nor shall this Document be construed in any way as investment, legal, or tax advice, or as a recommendation, reference, or endorsement by EquitiesFirst. You should seek independent financial advice prior to making an investment decision about a financial product.

This Document contains the intellectual property of EquitiesFirst in the United States and other countries, including, without limitation, their respective logos and other registered and unregistered trademarks and service marks. EquitiesFirst reserves all rights in and to their intellectual property contained in this Document. The Document should not be distributed, published, reproduced or otherwise made available in whole or in part by recipients to any other person and, in particular, should not be distributed to persons in any country where such distribution may lead to a breach of any legal or regulatory requirement.

EquitiesFirst make no representation or warranty with respect to this Document and expressly disclaim any implied warranty under law. You acknowledge that EquitiesFirst is not liable under any circumstances for any direct, indirect, special, consequential, incidental, or punitive damages whatsoever, including, without limitation, any lost profits or lost opportunity, even if EquitiesFirst has been advised of the possibility of such damages.

EquitiesFirst makes the following further statements that may be applicable in the stated jurisdiction:

Australia: Equities First Holdings (Australia) Pty Ltd (ACN: 142 644 399) holds an Australian Financial Services Licence (AFSL Number: 387079). All rights reserved.

The information contained on this Document is intended for persons located in Australia only and classified as a Wholesale Client only as defined in Section 761G of the Corporations Act 2001. The distribution of information to persons outside this criteria may be restricted by law and persons who come into possession of it should seek advice and observe any such restriction.

The material contained in this Document is for information purposes only and should not be construed as an offer or solicitation or recommendation to buy or sell financial products.

The information contained in this Document is intended to be general in nature and is not personal financial product advice. Any advice contained in the Document is general advice only and has been prepared without considering your objectives, financial situation or needs. Before acting on any information, you should consider the appropriateness of the information provided and the nature of the relevant financial product having regard to your objectives, financial situation and needs. You should seek independent financial advice and read the relevant disclosure statements or other offer documents prior to making an investment decision about a financial product.

Forecasts are not guaranteed, and undue reliance should not be placed on them. This information is based on views held by Equities First Holdings (Australia) Pty Ltd as at the publishing date of this material.

Dubai: Equities First Holdings Hong Kong Ltd (DIFC Representative Office) at Gate Precinct Building 4, 6th Floor, Office 7, Dubai International Financial Centre (commercial license number CL7354) is regulated by the Dubai Financial Services Authority (“DFSA”) as a Representative Office (DFSA Firm Reference No.: F008752). All rights reserved.

The information contained in this document is intended to be general in nature, and, to the extent that it is perceived as advice, any advice contained in this document is general advice only and has been prepared without considering your objectives, financial situation, suitability of the financial products or your needs.

The material contained in this document is for information purposes only and should not be construed as financial advice, including an offer or solicitation or recommendation to buy or sell financial products. The information contained in this document is intended to be general in nature and any advice contained in this document is general advice only and has been prepared without considering your objectives, financial situation, suitability of the financial products or your needs. Before acting on any information, you should consider the appropriateness of the information provided and the nature of the relevant financial product having regard to your objectives, financial situation and needs. If you do not understand the contents of this document, you should consult an authorised financial adviser.

This document relates to a financial product which is not subject to any form of regulation or approval by the DFSA. The DFSA has no responsibility for reviewing or verifying any documents in connection with this financial product. Accordingly, the DFSA has not approved this document or any other associated documents nor taken any steps to verify the information set out in this document, and has no responsibility for it.

Hong Kong: Equities First Holdings Hong Kong Limited is licensed under the Money Lenders Ordinance (Money Lender’s Licence No. 1659/2024) and to carry on the business of dealing in securities (Type 1 licence) under the Securities and Futures Ordinance (“SFO”) (CE No. BFJ407). This Document has not been reviewed by the Hong Kong Securities and Futures Commission. It is not intended as an offer to sell securities or a solicitation to buy any product managed or provided by Equities First Holdings Hong Kong Limited and is only intended for persons who qualify as Professional Investors under the SFO. This document is not directed to individuals or organizations for whom such offers or invitations would be unlawful or prohibited.

Korea: The foregoing is intended solely for sophisticated investors, professional investors or otherwise qualified investors who have sufficient knowledge and experience in entering into securities financing transactions. It is not intended for, and should not be used by, persons who do not meet those criteria.

United Kingdom: Equities First (London) Limited is authorised and regulated in the UK by the Financial Conduct Authority (“FCA”). In the UK, this Document is only being distributed and made available to persons of the kind described in Article 19(5) (investment professionals) and Article 49(2) (high net worth companies, unincorporated associations etc.) of Part IV of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (‘’FPO’’) and any investment activity to which this presentation relates is only available to, and will only be engaged in with, such persons. Persons who do not have professional experience in matters relating to investment or who are not persons to whom Article 49 of the FPO applies should not rely on this document. This Document is only prepared for and available to persons who qualify as Professional Investors under the Markets in Financial Instruments Directive.