Assessing the untapped potential of equity-backed lending in Asia’s high-growth markets

Global banks have made significant inroads in the region. However, we would argue that Asia’s potential in the private credit space is still far from being fully realized on multiple fronts.

According to recent Bloomberg figures, the global private credit market is worth an estimated US$800 billion. [1] Asia is a disproportionately small slice of that pie. In fact, by some estimates, Asia Pacific receives less than 10% of capital allocation to private credit strategies, even though the region delivers around one-third of global GDP. [2] This mismatch signals substantial untapped demand in view of the region’s long-term growth trajectory.

The rapid evolution of Greater China and other Asian economies, and rise of the region’s markets, offer huge opportunities for equity-backed lending, a versatile and innovative form of private credit in which owners of liquid stocks employ these assets as collateral to access capital.

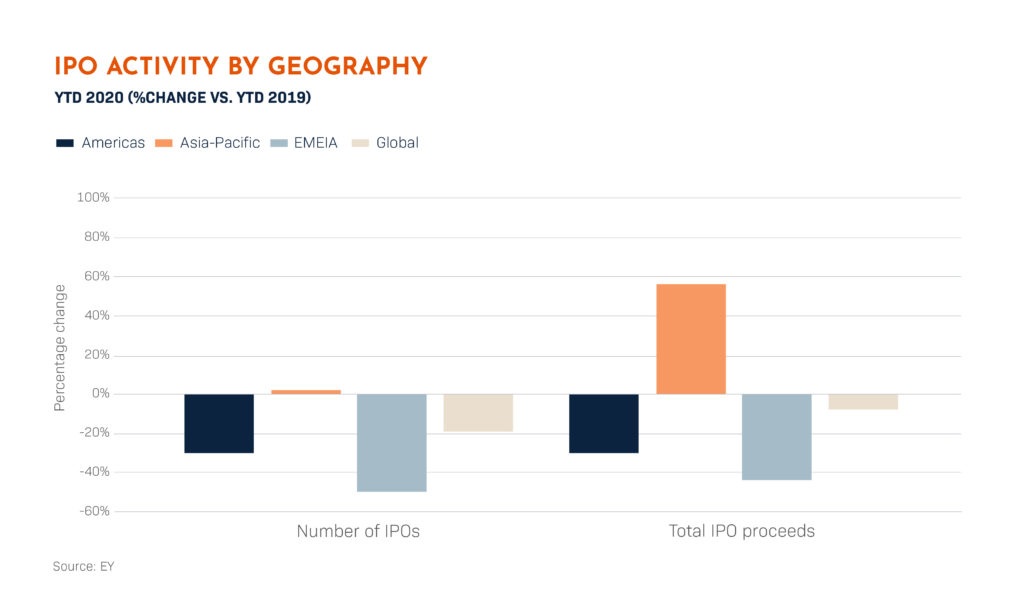

Asia Pacific stock markets have remained relatively robust engines of progress and prosperity even among the havoc that Covid-19 has brought to markets worldwide. One indicator of their vibrancy is the surge in IPO activity. In the first half of 2020, share listings in Greater China jumped 29% from the same period last year, and the amount of money that was raised rose 72%. The Hong Kong and Shanghai exchanges led the charge – underscoring the resilience of these two financial hubs. [3]

Benchmarks in South Korea, Japan and Taiwan have managed to post healthy gains over the last year despite at times volatile conditions. [4] Markets have been supported by both abundant liquidity and strong appetite from investors within in the region. Hong Kong’s market, for example, saw record inflows over the first quarter from the Connect scheme providing access to mainland Chinese investors. [5]

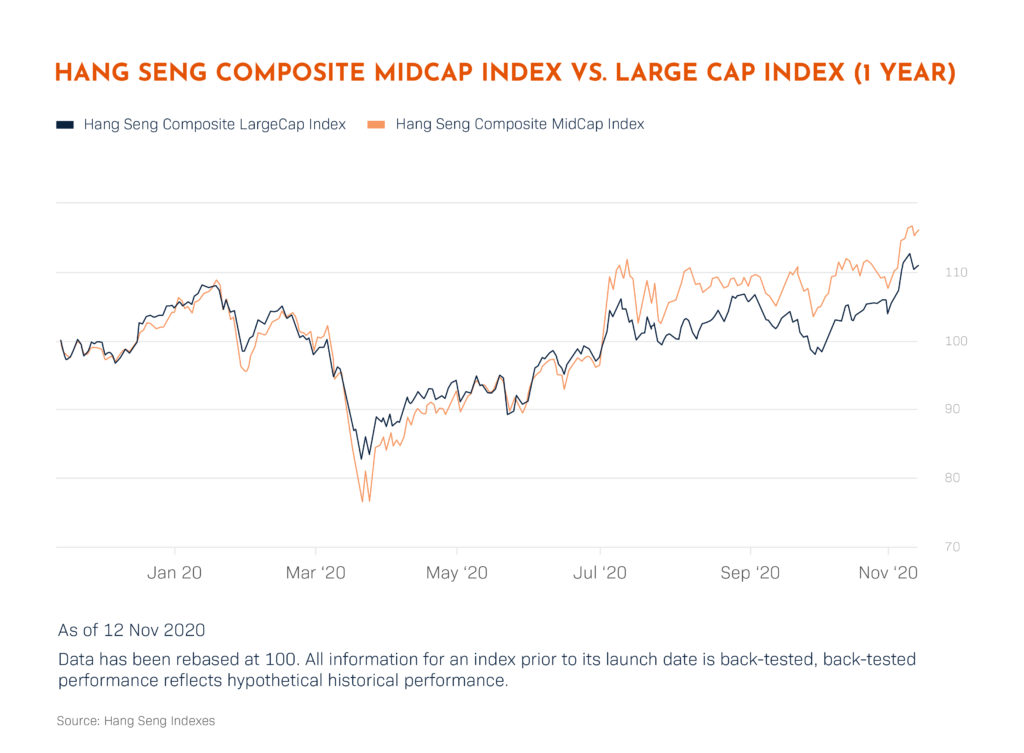

Interestingly, while the region has no shortage of corporate superstars, there are many indications lesser-known – but no less dynamic – mid-cap firms are where a lot of growth potential and investor interest are concentrated. For much of 2020, Tokyo’s Nikkei 225 benchmark has been roundly outperformed by the Nikkei 500, [6] a broader pool of more new economy and services-focused enterprises. Similarly, in Hong Kong the Hang Seng Composite MidCap Index produced around double the returns of its large cap counterpart. [7]

Investing in the region’s future

All this points to a growing and diverse network of regional investors who hold an expanding pool of high-potential assets, but can access only a limited range of funding opportunities. It is exactly this gap that equity-backed lending is designed to address.

We have identified chronically underserved borrower segments, especially in places like Hong Kong and South Korea, where investors and UHNWIs are keen to obtain funds for a range of purposes, from bolstering family businesses to diversifying investments. Yet, global banks are not positioned to offer effective solutions, and these investors are often unaware there is a sustainable means for them to access funding based on their equity portfolios.

This is why, after 20 years in this highly specialised sector, we now find ourselves registering the largest volume of new business among asset owners in Hong Kong, mainland China and South Korea. These markets continue to provide a healthy pipeline of transactions as the demand for liquidity – and financial security – increases.

This dynamism is precisely why EquitiesFirst is committed to investing further in our Asia operations. Our core Asia markets include China (Hong Kong), South Korea, Singapore and Thailand. We now have six offices in the region, most recently expanding our onshore China presence with offices in Beijing and Shanghai. The unique elements of our approach to equity-backed lending, which carefully balances the interests of lender and borrower, makes bricks-and-mortar presence key to engaging with each market and building long-term local partnerships.While other forms of funding will always have their place, our expertise and long-term approach to lending against equity allows us to be flexible and constructive on a broader population of assets. Listed shares with lower liquidity and higher volatility are difficult for banks to manage via traditional margin loans, but we understand that underlying these shares are often robust and sustainable businesses. By partnering and aligning interests with key shareholders, we see a tremendous opportunity to be a part of Asia’s growth story and the development of the regional private credit market.

[1] https://www.bloomberg.com/news/articles/2020-05-22/private-credit-market-to-see-m-a-as-virus-forces-consolidation

[2] https://www.asianinvestor.net/article/asias-4tr-funding-gap-luring-private-debt-investors/463296

[3] https://www.cnbc.com/2020/07/03/asia-listings-ipos-in-hong-kong-shanghai-jump-amid-pandemic-tensions.html

[4] https://www.bloomberg.com/markets/stocks/world-indexes/asia-pacific

[5] https://www.reuters.com/article/hkex-results/update-3-hong-kong-stock-exchange-ceo-li-to-step-down-next-year-idUKL4N2CP1AH

[6] https://www.bloomberg.com/markets/stocks/world-indexes/asia-pacific

[7] https://www.hsi.com.hk/eng/indexes/all-indexes/sizeindexes

Disclaimer

Past performance does not guarantee future returns, and individual returns are not guaranteed or warranted.

This Document is intended solely for accredited investors, sophisticated investors, professional investors, or otherwise qualified investors, as may be required by law or otherwise, and it is not intended for, and should not be used by, persons who do not meet the relevant requirements. The content provided herein is for informational purposes only and is general in nature and not targeted to any specific objective or financial need. The views and opinions expressed in this Document have been prepared by third parties and do not necessarily reflect the views and opinions of EquitiesFirst. EquitiesFirst has not independently examined or verified the information provided herein, and no representation is made that it is accurate or complete. Opinions and information herein are subject to change without notice. The content provided does not constitute an offer to sell (or solicitation of an offer to purchase) any securities, investments, or any financial products (“Offer”). Any such Offer shall only be made through a relevant offering or other documentation which sets forth its material terms and conditions. Nothing contained in this Document shall constitute a recommendation, solicitation, invitation, inducement, promotion, or offer for the purchase or sale of any investment product by Equities First Holdings, LLC or its subsidiaries (collectively, “EquitiesFirst”), nor shall this Document be construed in any way as investment, legal, or tax advice, or as a recommendation, reference, or endorsement by EquitiesFirst. You should seek independent financial advice prior to making an investment decision about a financial product.

This Document contains the intellectual property of EquitiesFirst in the United States and other countries, including, without limitation, their respective logos and other registered and unregistered trademarks and service marks. EquitiesFirst reserves all rights in and to their intellectual property contained in this Document. The Document should not be distributed, published, reproduced or otherwise made available in whole or in part by recipients to any other person and, in particular, should not be distributed to persons in any country where such distribution may lead to a breach of any legal or regulatory requirement.

EquitiesFirst make no representation or warranty with respect to this Document and expressly disclaim any implied warranty under law. You acknowledge that EquitiesFirst is not liable under any circumstances for any direct, indirect, special, consequential, incidental, or punitive damages whatsoever, including, without limitation, any lost profits or lost opportunity, even if EquitiesFirst has been advised of the possibility of such damages.

EquitiesFirst makes the following further statements that may be applicable in the stated jurisdiction:

Australia: Equities First Holdings (Australia) Pty Ltd (ACN: 142 644 399) holds an Australian Financial Services Licence (AFSL Number: 387079). All rights reserved.

The information contained on this Document is intended for persons located in Australia only and classified as a Wholesale Client only as defined in Section 761G of the Corporations Act 2001. The distribution of information to persons outside this criteria may be restricted by law and persons who come into possession of it should seek advice and observe any such restriction.

The material contained in this Document is for information purposes only and should not be construed as an offer or solicitation or recommendation to buy or sell financial products.

The information contained in this Document is intended to be general in nature and is not personal financial product advice. Any advice contained in the Document is general advice only and has been prepared without considering your objectives, financial situation or needs. Before acting on any information, you should consider the appropriateness of the information provided and the nature of the relevant financial product having regard to your objectives, financial situation and needs. You should seek independent financial advice and read the relevant disclosure statements or other offer documents prior to making an investment decision about a financial product.

Dubai: Equities First Holdings Hong Kong Ltd (DIFC Representative Office) at Gate Precinct Building 4, 6th Floor, Office 7, Dubai International Financial Centre (commercial license number CL7354) is regulated by the Dubai Financial Services Authority (“DFSA”) as a Representative Office (DFSA Firm Reference No.: F008752). All rights reserved.

The information contained in this document is intended to be general in nature, and, to the extent that it is perceived as advice, any advice contained in this document is general advice only and has been prepared without considering your objectives, financial situation, suitability of the financial products or your needs.

The material contained in this document is for information purposes only and should not be construed as financial advice, including an offer or solicitation or recommendation to buy or sell financial products. The information contained in this document is intended to be general in nature and any advice contained in this document is general advice only and has been prepared without considering your objectives, financial situation, suitability of the financial products or your needs. Before acting on any information, you should consider the appropriateness of the information provided and the nature of the relevant financial product having regard to your objectives, financial situation and needs. If you do not understand the contents of this document, you should consult an authorised financial adviser.

This document relates to a financial product which is not subject to any form of regulation or approval by the DFSA. The DFSA has no responsibility for reviewing or verifying any documents in connection with this financial product. Accordingly, the DFSA has not approved this document or any other associated documents nor taken any steps to verify the information set out in this document, and has no responsibility for it.

Hong Kong: Equities First Holdings Hong Kong Limited is licensed under the Money Lenders Ordinance (Money Lender’s Licence No. 1659/2024) and to carry on the business of dealing in securities (Type 1 licence) under the Securities and Futures Ordinance (“SFO”) (CE No. BFJ407). This Document has not been reviewed by the Hong Kong Securities and Futures Commission. It is not intended as an offer to sell securities or a solicitation to buy any product managed or provided by Equities First Holdings Hong Kong Limited and is only intended for persons who qualify as Professional Investors under the SFO. This document is not directed to individuals or organizations for whom such offers or invitations would be unlawful or prohibited.

Korea: The foregoing is intended solely for sophisticated investors, professional investors or otherwise qualified investors who have sufficient knowledge and experience in entering into securities financing transactions. It is not intended for, and should not be used by, persons who do not meet those criteria.

United Kingdom: Equities First (London) Limited is authorised and regulated in the UK by the Financial Conduct Authority (“FCA”). In the UK, this Document is only being distributed and made available to persons of the kind described in Article 19(5) (investment professionals) and Article 49(2) (high net worth companies, unincorporated associations etc.) of Part IV of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (‘’FPO’’) and any investment activity to which this presentation relates is only available to, and will only be engaged in with, such persons. Persons who do not have professional experience in matters relating to investment or who are not persons to whom Article 49 of the FPO applies should not rely on this document. This Document is only prepared for and available to persons who qualify as Professional Investors under the Markets in Financial Instruments Directive.