UK equity-backed lending: substantial growth since 2019

UK Equity-Backed Lending: Substantial Growth Since 2019

- Number of disclosed loans backed by UK-listed shares more than doubled year-on-year to 22 in 2020, set to grow again in 2021 with 16 completed by the end of August 2021, according to new research by EquitiesFirst[1]

- Value of share-backed loans to directors of UK-listed companies estimated at £1.55 billion in 2020; £269 million in the year to August 2021

- Observers see an increasingly broad-based market, driven by growing awareness, a buoyant stock market and low interest rates

Equity-backed financing is more popular than ever as an alternative source of liquidity for significant shareholders in UK-listed companies. We explore the reasons why the market has reached new highs in the last two years – and what will drive its growth from here.

Loans backed by pledged shares in UK-listed companies are taking off as a growing number of investors look to raise money from their shareholdings, according to new research by EquitiesFirst, an institutional investment firm that specialises in long-term asset-backed financing.

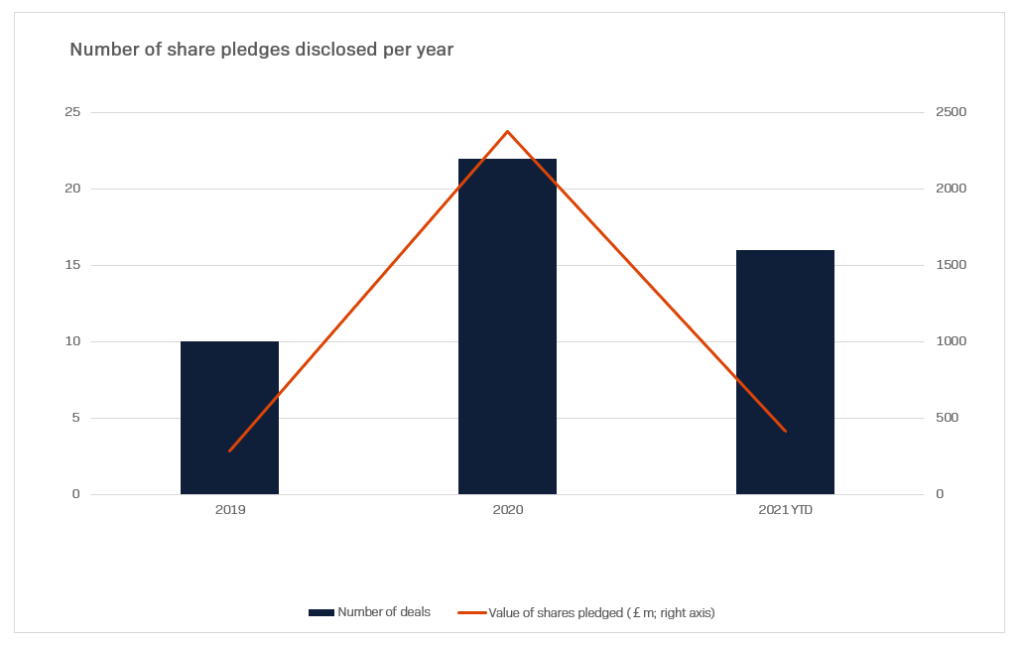

The number of equity-backed loans disclosed by directors of UK-listed companies more than doubled in 2020 compared with the previous year, EquitiesFirst found. Based on the trend observed so far in 2021, the transaction count is also on course to grow again in the full year, although the volume of loan proceeds raised may decline.

By the end of August 2021, 16 transactions involving shares pledged by directors or their connected parties had been disclosed, according to an analysis of public filings with the London Stock Exchange. Companies disclosed a total of 22 such loans throughout 2020, compared with 10 in 2019.[2]

Source: LSE disclosures

Share pledges disclosed by directors in the year to August were worth over £412 million at the time the transactions were made public, compared with almost £2.4 billion in all of 2020. Using a typical industry loan-to-value (LTV) ratio of 65%, EquitiesFirst calculates that these pledges translated into loans worth some £1.55 billion in 2020 and £269 million in the year to August 2021.

Tip of the iceberg

These figures provide new insight into the evolution of share-backed financing, which is commonly referred to as Lombard lending in the UK. Market observers see it becoming increasingly broad-based, developing from a tool for high-net-worth individuals with billions of dollars of assets into an increasingly mainstream source of funding.

Indeed, the more recent LSE data analysed by EquitiesFirst shows that share-backed financing is being used by a wider range of individual investors looking to raise smaller amounts of capital against shares in a broad spectrum of listed companies.

Close to half the firms in which stock was pledged in the last two years were in the benchmark FTSE100 or 250 indices, according to the data analysed by EquitiesFirst. However, experts point out that larger and more liquid stocks are typically eligible as collateral for margin lending from large banks, which does not necessarily have to be disclosed by directors since it may involve no change of title over the underlying shares.

Since it is derived exclusively from London Stock Exchange disclosures, this data is only the “tip of the iceberg”, according to James Mungovan, CEO for Europe at EquitiesFirst. “Without question, the universe of borrowers is growing and there is an increased understanding that share-backed financing can be a great way to access liquidity for a very wide range of purposes without having to sell your shares.”

London Stock Exchange rules require companies to disclose share dealings, including pledges, by persons discharging managerial responsibilities: board directors, senior executives and people or entities connected with them. Disclosure requirements for major investors who are not directors sometimes also require information about certain share pledges to be disclosed.

Beyond these disclosures, though, public data is limited and the personal nature of these transactions – although they involve shares in listed companies – means the industry places a premium on privacy and discretion. These qualities are essential, says Mungovan at EquitiesFirst, but awareness is growing. “Share-backed financing has been something of a well-kept secret,” he argues. “It will always be an inherently private market but its value is becoming more widely recognised.”

Rising tide

A share-backed loan is a relatively straightforward concept. In the same way that a mortgage secured by a property carries a lower interest rate than unsecured borrowing with a credit card, a loan backed by a portfolio of public securities can give an investor flexible funding at an attractive borrowing cost.

Borrowing against stock can be an attractive alternative to an outright sale. The borrower – a company director, major shareholder or other long-term investor – can retain the economic benefits of the pledged shares, including dividends and gains from stock price appreciation.

This has all been true for decades, though. So why is equity-backed financing suddenly in vogue? Experts point to a number of reasons, ranging from rising demand from high-net-worth clients to changes taking place in the banking system.

The UK economic recovery is gaining momentum as the government lifts most of the restrictions forced by the Covid-19 pandemic.

“As business activity picks up, you’ll see more interest as people are looking to release funds from their static equity positions,” says Mungovan at EquitiesFirst. Uses of loans can range from diversification into property assets to further investment in the company, whether through exercising options, putting in place credit lines and everything in between, he added.[3]

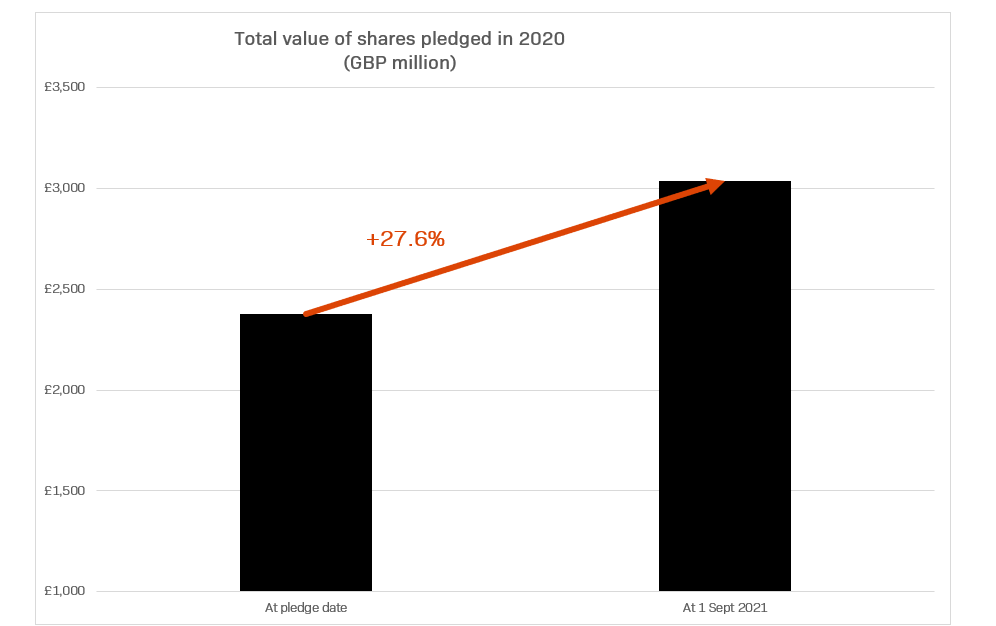

Strong equity markets also reinforce the case for using share-backed loans as a way to monetise equity holdings, rather than simply selling the shares. As part of EquitiesFirst’s analysis, we measured the net gains from the portfolio of stocks that were pledged during 2020. Worth £2.4 billion at the time they were pledged, these shares were worth some £3.0 billion as of September 1, based on their last traded price, meaning that investors would have missed out on over £600 million of capital appreciation had they sold those shares instead.[4]

Source: LSE disclosures

The ability to retain the equity upside can be especially compelling for the founders and major shareholders of high-growth growth companies, such as fintech and biotech businesses.

Efficient capital

On the supply side, banks and specialist providers are finding that equity-backed lending can be an efficient use of their capital. With liquid securities as collateral, share-backed loans take up less of a bank’s regulatory capital than unsecured or corporate credit lines – one reason why so many banks are looking to grow their private wealth businesses.

While credit conditions have been tighter in the UK since the start of the pandemic, according to the Bank of England, accommodative fiscal and monetary policy has boosted the liquidity of lenders’ balance sheets.[5]

“You’ve got an awful lot of banks with an awful lot of cash in a system that’s awash with money,” said Bill Foley, the Founder of SecFinHub, a specialist securities financing consultancy. “They’re effectively looking for assets that are sitting idle.”

But market experts also identify a clear distinction in the share-backed lending market. Banks have strong appetite to lend against large- and mega-cap stocks, but are less willing to lend against shares in smaller companies. That means that financing investors in mid- or small-cap stocks is typically the domain of specialist lenders like EquitiesFirst.

“Ever since 2008, banks have retreated from various forms of lending, especially on more opaque, private assets,” said Joe Hodgins, Director of Bridging Capital, a private lending specialist.

At the same time, though, very low yields are encouraging more investors to monetise their portfolios and move into private assets as a way to boost returns, he said.

“In recent times we’ve seen more and more clients looking to go down this route because they’re looking for any way to release trapped liquidity and put it to work,” added Mr. Hodgins, who was previously the Illiquid Lending Lead in Private Client Solutions at Julius Baer and European Head of Credit and Banking in Wealth Management at Bank of America Merrill Lynch. “The old days of sitting on a lot of cash and earning interest are gone.”

Looking to the future

In parallel with share-backed lending, the private wealth industry is also helping high-net worth individuals monetise their investments in other ways. In one example, Citi recently established a partnership with fintech company Sharegain to offer securities lending services to wealth management clients. Through aggregating their assets, the platform allows investors to earn an income from their portfolio by lending out their shares.

That shows how technology is creating new opportunities for equity holders, said Foley, who believes that a similar digital platform could make it possible for individuals to borrow more easily against their portfolios. “The private client market is huge, competitive and evolving,” he says. “The profile of this type of business within wealth management is changing.”

Whatever the future holds, a strengthening economic recovery and rebounding equity markets have helped make 2020 and 2021 breakout years for equity-backed lending in the UK. While liquidity remains abundant and investors confident, there is every indication that this versatile form of financing will become a much less well-kept secret.

[1] In this new research, EquitiesFirst conducted proprietary analysis of share pledges disclosed to the London Stock Exchange by company directors and connected parties between 2016 and the year to the end of August 2021.

[2] Source: LSE disclosures

[3]https://www.ons.gov.uk/economy/grossdomesticproductgdp/bulletins/gdpfirstquarterlyestimateuk/apriltojune2021

[5] https://equitiesfirst.com/hk/articles/tightening-credit-conditions-highlight-role-for-innovative-financing-in-the-uk-and-eu/

Disclaimer

Past performance does not guarantee future returns, and individual returns are not guaranteed or warranted.

This Document is intended solely for accredited investors, sophisticated investors, professional investors, or otherwise qualified investors, as may be required by law or otherwise, and it is not intended for, and should not be used by, persons who do not meet the relevant requirements. The content provided herein is for informational purposes only and is general in nature and not targeted to any specific objective or financial need. The views and opinions expressed in this Document have been prepared by third parties and do not necessarily reflect the views and opinions of EquitiesFirst. EquitiesFirst has not independently examined or verified the information provided herein, and no representation is made that it is accurate or complete. Opinions and information herein are subject to change without notice. The content provided does not constitute an offer to sell (or solicitation of an offer to purchase) any securities, investments, or any financial products (“Offer”). Any such Offer shall only be made through a relevant offering or other documentation which sets forth its material terms and conditions. Nothing contained in this Document shall constitute a recommendation, solicitation, invitation, inducement, promotion, or offer for the purchase or sale of any investment product by Equities First Holdings, LLC or its subsidiaries (collectively, “EquitiesFirst”), nor shall this Document be construed in any way as investment, legal, or tax advice, or as a recommendation, reference, or endorsement by EquitiesFirst. You should seek independent financial advice prior to making an investment decision about a financial product.

This Document contains the intellectual property of EquitiesFirst in the United States and other countries, including, without limitation, their respective logos and other registered and unregistered trademarks and service marks. EquitiesFirst reserves all rights in and to their intellectual property contained in this Document. The Document should not be distributed, published, reproduced or otherwise made available in whole or in part by recipients to any other person and, in particular, should not be distributed to persons in any country where such distribution may lead to a breach of any legal or regulatory requirement.

EquitiesFirst make no representation or warranty with respect to this Document and expressly disclaim any implied warranty under law. You acknowledge that EquitiesFirst is not liable under any circumstances for any direct, indirect, special, consequential, incidental, or punitive damages whatsoever, including, without limitation, any lost profits or lost opportunity, even if EquitiesFirst has been advised of the possibility of such damages.

EquitiesFirst makes the following further statements that may be applicable in the stated jurisdiction:

Australia: Equities First Holdings (Australia) Pty Ltd (ACN: 142 644 399) holds an Australian Financial Services Licence (AFSL Number: 387079). All rights reserved.

The information contained on this Document is intended for persons located in Australia only and classified as a Wholesale Client only as defined in Section 761G of the Corporations Act 2001. The distribution of information to persons outside this criteria may be restricted by law and persons who come into possession of it should seek advice and observe any such restriction.

The material contained in this Document is for information purposes only and should not be construed as an offer or solicitation or recommendation to buy or sell financial products.

The information contained in this Document is intended to be general in nature and is not personal financial product advice. Any advice contained in the Document is general advice only and has been prepared without considering your objectives, financial situation or needs. Before acting on any information, you should consider the appropriateness of the information provided and the nature of the relevant financial product having regard to your objectives, financial situation and needs. You should seek independent financial advice and read the relevant disclosure statements or other offer documents prior to making an investment decision about a financial product.

Dubai: Equities First Holdings Hong Kong Ltd (DIFC Representative Office) at Gate Precinct Building 4, 6th Floor, Office 7, Dubai International Financial Centre (commercial license number CL7354) is regulated by the Dubai Financial Services Authority (“DFSA”) as a Representative Office (DFSA Firm Reference No.: F008752). All rights reserved.

The information contained in this document is intended to be general in nature, and, to the extent that it is perceived as advice, any advice contained in this document is general advice only and has been prepared without considering your objectives, financial situation, suitability of the financial products or your needs.

The material contained in this document is for information purposes only and should not be construed as financial advice, including an offer or solicitation or recommendation to buy or sell financial products. The information contained in this document is intended to be general in nature and any advice contained in this document is general advice only and has been prepared without considering your objectives, financial situation, suitability of the financial products or your needs. Before acting on any information, you should consider the appropriateness of the information provided and the nature of the relevant financial product having regard to your objectives, financial situation and needs. If you do not understand the contents of this document, you should consult an authorised financial adviser.

This document relates to a financial product which is not subject to any form of regulation or approval by the DFSA. The DFSA has no responsibility for reviewing or verifying any documents in connection with this financial product. Accordingly, the DFSA has not approved this document or any other associated documents nor taken any steps to verify the information set out in this document, and has no responsibility for it.

Hong Kong: Equities First Holdings Hong Kong Limited is licensed under the Money Lenders Ordinance (Money Lender’s Licence No. 1659/2024) and to carry on the business of dealing in securities (Type 1 licence) under the Securities and Futures Ordinance (“SFO”) (CE No. BFJ407). This Document has not been reviewed by the Hong Kong Securities and Futures Commission. It is not intended as an offer to sell securities or a solicitation to buy any product managed or provided by Equities First Holdings Hong Kong Limited and is only intended for persons who qualify as Professional Investors under the SFO. This document is not directed to individuals or organizations for whom such offers or invitations would be unlawful or prohibited.

Korea: The foregoing is intended solely for sophisticated investors, professional investors or otherwise qualified investors who have sufficient knowledge and experience in entering into securities financing transactions. It is not intended for, and should not be used by, persons who do not meet those criteria.

United Kingdom: Equities First (London) Limited is authorised and regulated in the UK by the Financial Conduct Authority (“FCA”). In the UK, this Document is only being distributed and made available to persons of the kind described in Article 19(5) (investment professionals) and Article 49(2) (high net worth companies, unincorporated associations etc.) of Part IV of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (‘’FPO’’) and any investment activity to which this presentation relates is only available to, and will only be engaged in with, such persons. Persons who do not have professional experience in matters relating to investment or who are not persons to whom Article 49 of the FPO applies should not rely on this document. This Document is only prepared for and available to persons who qualify as Professional Investors under the Markets in Financial Instruments Directive.