Keeping private credit on a sustainable growth path

As a committed specialist in this space, we’re confident it will play an integral role in helping individuals, businesses and entire economies weather the impacts of the pandemic, and pursue the opportunities that will come with recovery. Here are the main reasons why.

Bridging a gap

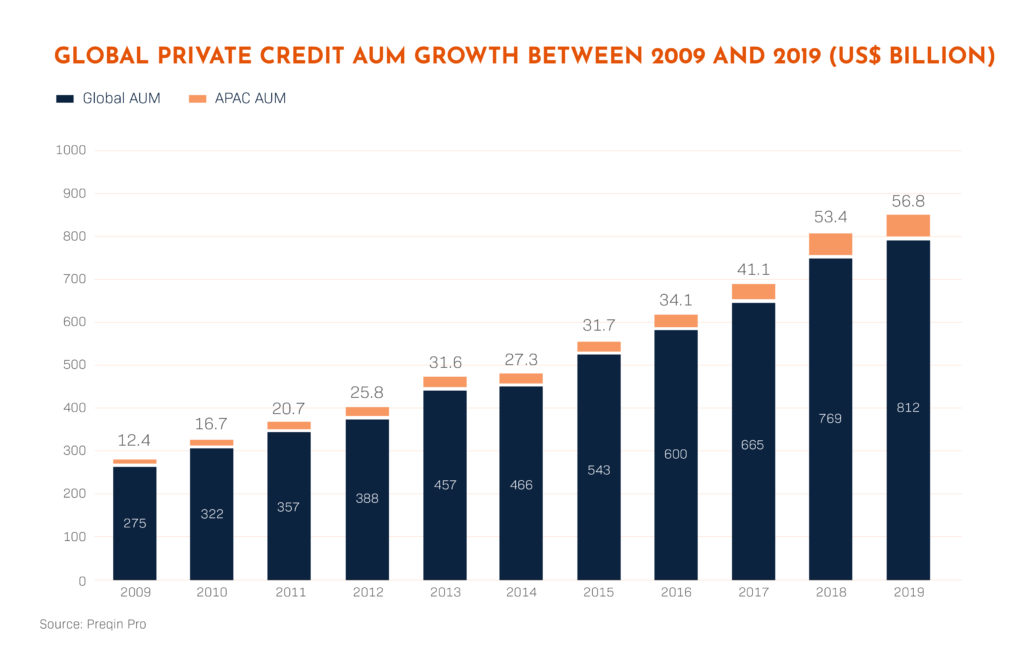

The first is the retrenchment of banks from the lending market since the 2007-2008 financial crisis, a trend that the pandemic looks set to accelerate[1] With small and mid-market firms in particular struggling to access financing from traditional sources, private credit assets under management (AUM) globally surged from US$275 billion in 2009 to over US$800 billion in 2019.[2] The Alternative Credit Council has forecast the total could hit US$1 trillion this year.[3]

With this growth has come recognition that private credit is not a niche concern, but an essential element of the global financing landscape. Around a third of committed capital goes to small and medium-sized companies. These are the lifeblood of most economies, accounting for 90 percent of businesses and 50 percent of employment worldwide.[4]

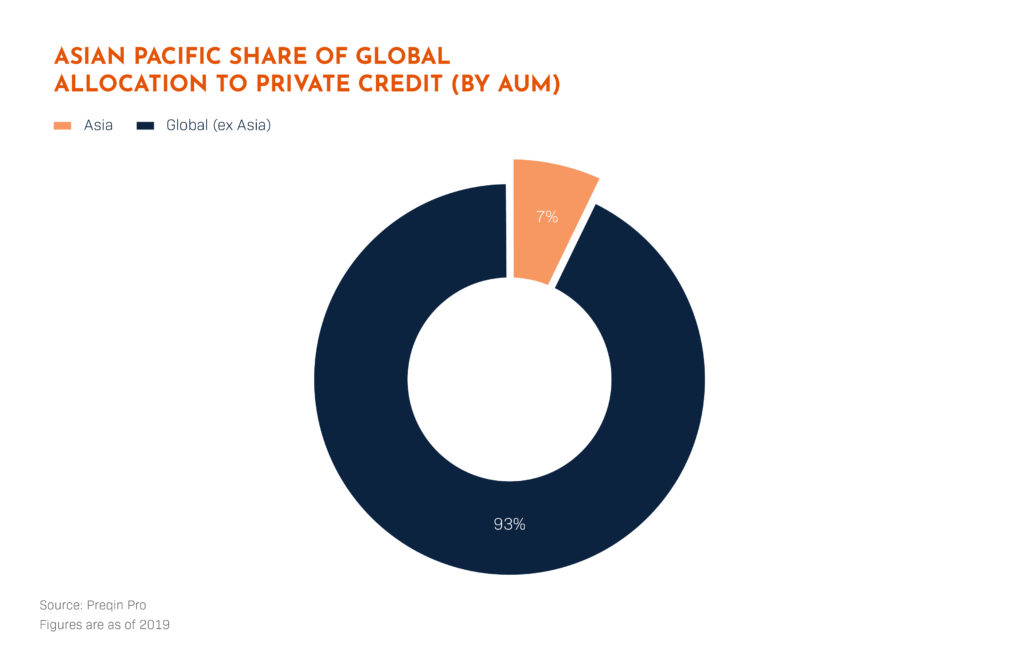

Another reason for optimism is that private credit still has plenty of room to expand, particularly in Asia. While private credit AUM in Asia doubled from 2014 to last year, such assets still represent a mere sliver of AUM worldwide, a proportion vastly out of kilter with the region’s role in global economic growth.[5]

Research also points to significant untapped demand among Asian borrowers. One recent poll by Acuris found 68% of mid-market firms in the region viewed financing from non-traditional lenders as critical to their business, and that 82% planned to seek such financing in the year ahead.[6]

A flexible funding source

This appetite brings us to the third major success factor for private credit: its inherent flexibility. As Acuris points out, traditional lenders contend with bureaucratic processes and are typically confined to providing loans in defined formats and under certain conditions. Such arrangements are not always optimal for enterprises or entrepreneurs with distinct business models or funding requirements.

While any reputable provider of private credit must also be mindful of regulation and a borrower’s risk profile, in general non-bank lenders are able to disburse capital more efficiently and have more room for maneuver to meet borrower needs.

Private credit also benefits from its diversity. It is a vast space spanning strategies from mezzanine financing to direct lending, each offering its own means to manage risks and mobilize capital. This means funding can be generated in all kinds of market conditions, and that there are options for virtually all would-be borrowers and investors.

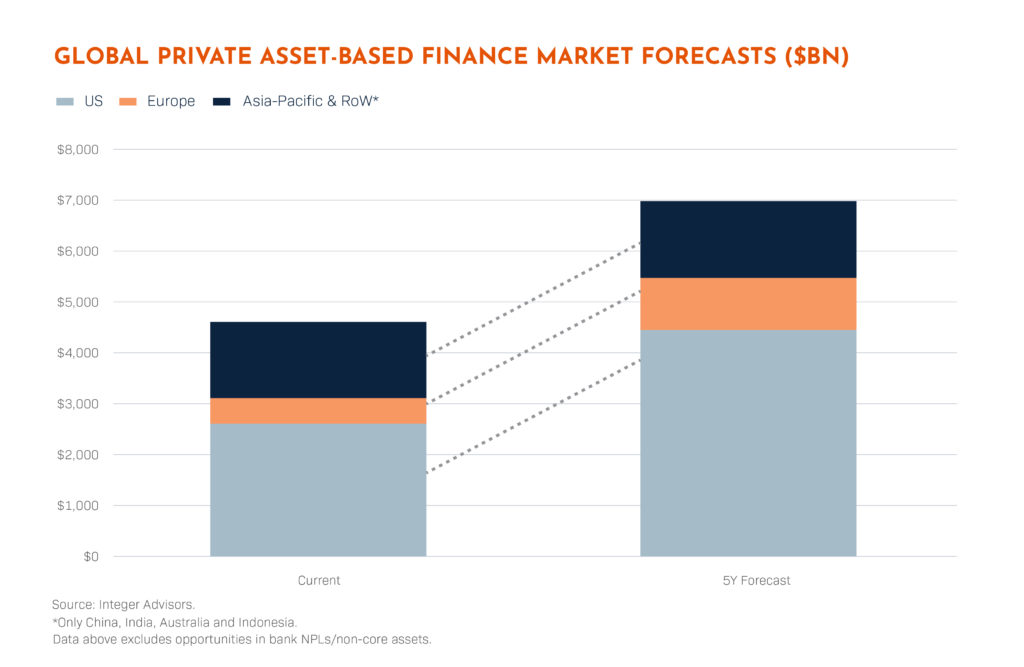

Our area of expertise, private asset-based finance, alone is a US$4.5 trillion market globally, forecast to rise to US$6.9 trillion over the next five years, according to KKR.[7]

As traditional lenders face even more constraints in the wake of COVID-19, asset-backed lending is expected to become a ‘go-to’ source of credit. Like other types of private credit, it is versatile, since virtually any asset, from real estate to aircraft, even contracts, can serve as a basis for funding.

Though loans need to be structured carefully, in general risks are limited by the lender’s ability to recover this collateral, and by the increasingly sophisticated, technology-based processes being applied to deal origination, underwriting and risk management.

Bright prospects for equity-backed lending

Drilling down further within asset-based finance, we see equity-backed lending emerging as a prominent funding source as it ticks so many boxes for both lenders and borrowers.

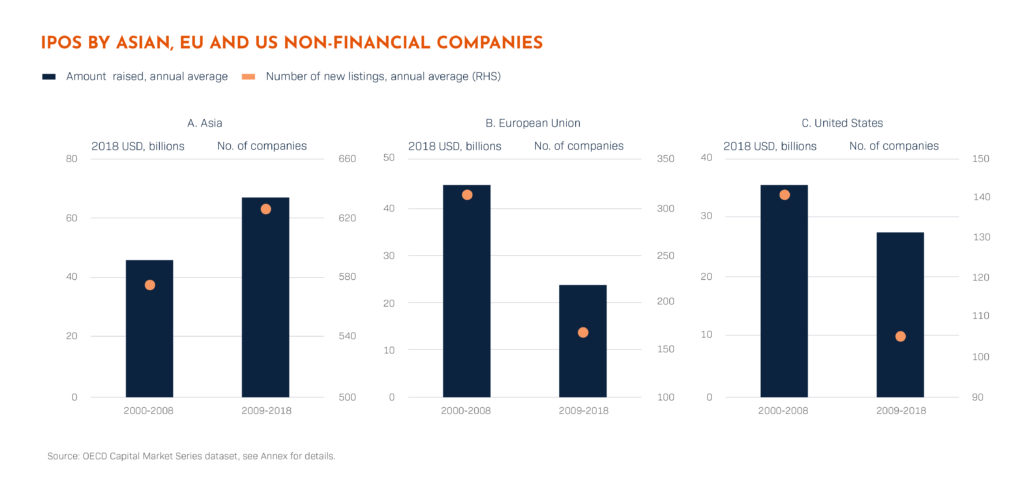

Equity markets have proven to be massive engines of value in recent years and the untapped potential being unlocked in emerging markets shows this is set to continue. Particularly in Asia’s dynamic economies, a rising middle class, growing ranks of entrepreneurs and vigorous listing activity will all help expand the pool of stock owners.

Flourishing businesses and wealth will fuel demand for funding to drive the next stage of growth, or meet personal ambitions. Equity-backed lending is ideally situated to meet this demand, as unlike margin lending it is typically non-purpose. That means the borrower is free to deploy the capital however they see fit. Equity-backed loans are also generally non-recourse, meaning the borrower’s liability is limited to the collateral.

Furthermore, equity-backed loans offer the borrower an opportunity to tap into the value of their investments without sacrificing the potential for market appreciation. Once a loan is repaid, the securities used as collateral are returned in full. If they have appreciated during the term of the loan, the borrower is still in a position to benefit. Meanwhile, having a relatively liquid asset as collateral allows the lender to offer highly competitive terms and rates, and to gain from temporarily adding the stock to their own portfolio.

Equity-backed lending is therefore arguably unmatched in its ability to serve both lender and borrower interests. Our faith in the model and its potential is the reason we have chosen to focus exclusively on this space, and worked to perfect our approach to it over the last two decades.

While we see significant potential for near-term growth in asset-backed lending, we are also conscious that, like the rest of private credit, it cannot simply grow; it needs to do so sustainably.

This is why in addition to bringing our solutions to more borrowers, and extending our capabilities to areas like digital assets,[8] we are investing heavily in building local networks, and forging close relationships with regulators and institutional partners.

Demonstrating commitment, and working closely with other stakeholders to enhance the range of funding options available without compromising standards or governance, is key to ensuring private credit is no longer viewed as an ‘alternative’ form of lending, but as a vital and vibrant part of the spectrum of solutions channeling capital where it is needed to fund future prosperity.

[1] www.allianzgi.com/en/insights/investment-themes-and-strategy/private-lending-post-covid-19

[2] www.simmons-simmons.com/en/publications/ckecj9sk3182c09430t4lsd0i/private-credit-in-asia-report

[3] www.aima.org/article/acc-sees-private-credit-market-reaching-1-trillion-by-2020.html

[4] www.worldbank.org/en/topic/smefinance

[5] www.simmons-simmons.com/en/publications/ckecj9sk3182c09430t4lsd0i/private-credit-in-asia-report

[6] www.acuris.com/asian_mid-market_direct_lending_report

[7] www.kkr.com/sites/default/files/Asset_Based_Finance_Q2_2020.pdf

[8] osl.com/en/in-the-news/press-releases/20200616efhpressrelease

Disclaimer

Past performance does not guarantee future returns, and individual returns are not guaranteed or warranted.

This Document is intended solely for accredited investors, sophisticated investors, professional investors, or otherwise qualified investors, as may be required by law or otherwise, and it is not intended for, and should not be used by, persons who do not meet the relevant requirements. The content provided herein is for informational purposes only and is general in nature and not targeted to any specific objective or financial need. The views and opinions expressed in this Document have been prepared by third parties and do not necessarily reflect the views and opinions of EquitiesFirst. EquitiesFirst has not independently examined or verified the information provided herein, and no representation is made that it is accurate or complete. Opinions and information herein are subject to change without notice. The content provided does not constitute an offer to sell (or solicitation of an offer to purchase) any securities, investments, or any financial products (“Offer”). Any such Offer shall only be made through a relevant offering or other documentation which sets forth its material terms and conditions. Nothing contained in this Document shall constitute a recommendation, solicitation, invitation, inducement, promotion, or offer for the purchase or sale of any investment product by Equities First Holdings, LLC or its subsidiaries (collectively, “EquitiesFirst”), nor shall this Document be construed in any way as investment, legal, or tax advice, or as a recommendation, reference, or endorsement by EquitiesFirst. You should seek independent financial advice prior to making an investment decision about a financial product.

This Document contains the intellectual property of EquitiesFirst in the United States and other countries, including, without limitation, their respective logos and other registered and unregistered trademarks and service marks. EquitiesFirst reserves all rights in and to their intellectual property contained in this Document. The Document should not be distributed, published, reproduced or otherwise made available in whole or in part by recipients to any other person and, in particular, should not be distributed to persons in any country where such distribution may lead to a breach of any legal or regulatory requirement.

EquitiesFirst make no representation or warranty with respect to this Document and expressly disclaim any implied warranty under law. You acknowledge that EquitiesFirst is not liable under any circumstances for any direct, indirect, special, consequential, incidental, or punitive damages whatsoever, including, without limitation, any lost profits or lost opportunity, even if EquitiesFirst has been advised of the possibility of such damages.

EquitiesFirst makes the following further statements that may be applicable in the stated jurisdiction:

Australia: Equities First Holdings (Australia) Pty Ltd (ACN: 142 644 399) holds an Australian Financial Services Licence (AFSL Number: 387079). All rights reserved.

The information contained on this Document is intended for persons located in Australia only and classified as a Wholesale Client only as defined in Section 761G of the Corporations Act 2001. The distribution of information to persons outside this criteria may be restricted by law and persons who come into possession of it should seek advice and observe any such restriction.

The material contained in this Document is for information purposes only and should not be construed as an offer or solicitation or recommendation to buy or sell financial products.

The information contained in this Document is intended to be general in nature and is not personal financial product advice. Any advice contained in the Document is general advice only and has been prepared without considering your objectives, financial situation or needs. Before acting on any information, you should consider the appropriateness of the information provided and the nature of the relevant financial product having regard to your objectives, financial situation and needs. You should seek independent financial advice and read the relevant disclosure statements or other offer documents prior to making an investment decision about a financial product.

Forecasts are not guaranteed, and undue reliance should not be placed on them. This information is based on views held by Equities First Holdings (Australia) Pty Ltd as at the publishing date of this material.

Dubai: Equities First Holdings Hong Kong Ltd (DIFC Representative Office) at Gate Precinct Building 4, 6th Floor, Office 7, Dubai International Financial Centre (commercial license number CL7354) is regulated by the Dubai Financial Services Authority (“DFSA”) as a Representative Office (DFSA Firm Reference No.: F008752). All rights reserved.

The information contained in this document is intended to be general in nature, and, to the extent that it is perceived as advice, any advice contained in this document is general advice only and has been prepared without considering your objectives, financial situation, suitability of the financial products or your needs.

The material contained in this document is for information purposes only and should not be construed as financial advice, including an offer or solicitation or recommendation to buy or sell financial products. The information contained in this document is intended to be general in nature and any advice contained in this document is general advice only and has been prepared without considering your objectives, financial situation, suitability of the financial products or your needs. Before acting on any information, you should consider the appropriateness of the information provided and the nature of the relevant financial product having regard to your objectives, financial situation and needs. If you do not understand the contents of this document, you should consult an authorised financial adviser.

This document relates to a financial product which is not subject to any form of regulation or approval by the DFSA. The DFSA has no responsibility for reviewing or verifying any documents in connection with this financial product. Accordingly, the DFSA has not approved this document or any other associated documents nor taken any steps to verify the information set out in this document, and has no responsibility for it.

Hong Kong: Equities First Holdings Hong Kong Limited is licensed under the Money Lenders Ordinance (Money Lender’s Licence No. 1659/2024) and to carry on the business of dealing in securities (Type 1 licence) under the Securities and Futures Ordinance (“SFO”) (CE No. BFJ407). This Document has not been reviewed by the Hong Kong Securities and Futures Commission. It is not intended as an offer to sell securities or a solicitation to buy any product managed or provided by Equities First Holdings Hong Kong Limited and is only intended for persons who qualify as Professional Investors under the SFO. This document is not directed to individuals or organizations for whom such offers or invitations would be unlawful or prohibited.

Korea: The foregoing is intended solely for sophisticated investors, professional investors or otherwise qualified investors who have sufficient knowledge and experience in entering into securities financing transactions. It is not intended for, and should not be used by, persons who do not meet those criteria.

United Kingdom: Equities First (London) Limited is authorised and regulated in the UK by the Financial Conduct Authority (“FCA”). In the UK, this Document is only being distributed and made available to persons of the kind described in Article 19(5) (investment professionals) and Article 49(2) (high net worth companies, unincorporated associations etc.) of Part IV of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (‘’FPO’’) and any investment activity to which this presentation relates is only available to, and will only be engaged in with, such persons. Persons who do not have professional experience in matters relating to investment or who are not persons to whom Article 49 of the FPO applies should not rely on this document. This Document is only prepared for and available to persons who qualify as Professional Investors under the Markets in Financial Instruments Directive.