As traditional lenders retreat, securities backed financing marches on

The US Federal Reserve has now brought interest rates to their highest level in 22 years following its latest hike on July 26 – and it has not ruled out further increases.[1]

Acknowledging that the impact of tighter credit conditions on businesses and consumers remains uncertain, Federal Reserve Chairman Jerome Powell called on would-be borrowers to consider carefully whether now is the appropriate time to secure loans for investment and growth.[2] The trouble is, even if the answer is yes, they might not be able to obtain them from traditional sources.

Fortunately, companies struggling to raise funding from public bond and loan markets are finding they can turn to private financing. These companies report that, in contrast to traditional lenders’ reluctance or perhaps inability to provide funding, private financing providers are willing and appear to have “significant liquidity” to meet their needs.[3]

Indeed, current circumstances have provided private financing an opportunity to shine.

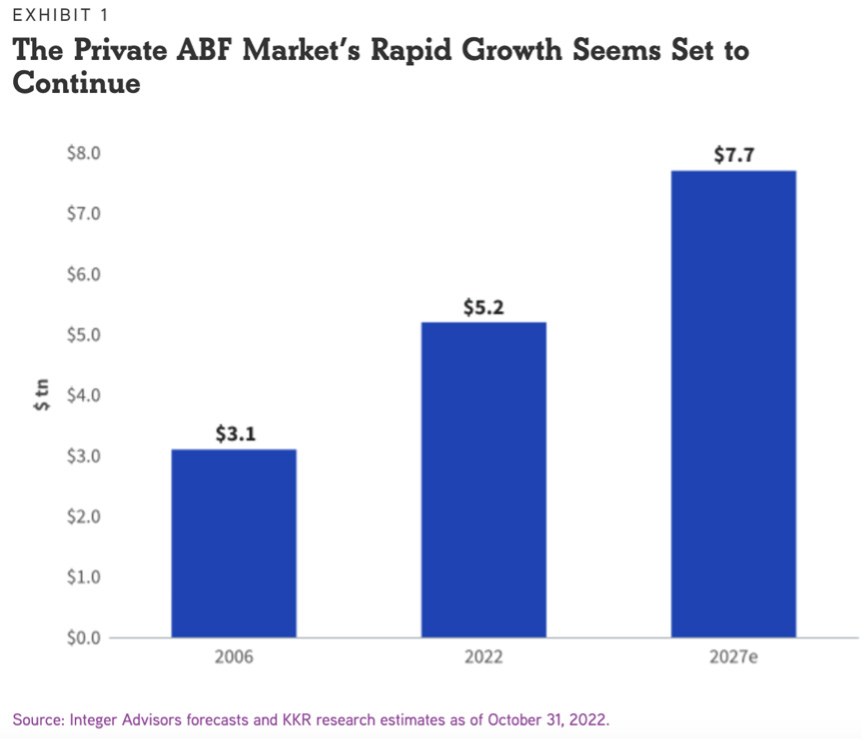

One category that looks set to accelerate after having ramped up steadily in the wake of the 2008 Global Financial Crisis is private asset-based finance (ABF).[4] From an estimated $3.1 trillion in 2006, the market grew to $5.2 trillion by 2022. And according to projections from leading global alternative investment managers KKR, it could expand further to 7.7 trillion by 2027, spurred on by the retreat of traditional lenders in response to rising interest rates and volatility in the banking system.[5]

Private ABF is an attractive proposition for long-term shareholders and other investors, particularly at a time of heightened economic and geopolitical uncertainty. It provides a potential inflation hedge, downside protection and access to lenders who are less exposed to short-term market movements.

EquitiesFirst’s progressive brand of asset-based finance – securities-backed financing – allows investors to use their equities or crypto to unlock capital for other needs while still maintaining upside participation in those holdings.

These investors can use the funds for a variety of business or personal purposes. Additional benefits include greater stability should central bank tightening persist and economic growth stall, as well as more diversified returns.

Moreover, with securities-backed financing, interests are aligned during the term of the loan as the investor’s equity is transferred to become a part of the EquitiesFirst portfolio and EquitiesFirst also becomes an investor in the stock alongside the owner.

As a dedicated securities-backed lender, we have worked tirelessly over the years to streamline and enhance our processes in a way that benefits the parties on both sides of each transaction. As such, we are able to offer a level of efficiency that other capital providers – such as banks and other large financial institutions, for whom asset-based finance is merely a niche product – are simply not in a position to provide.

Managing risks

We are also cautious about how we manage our own risks – putting us in a favourable position during these challenging times.

Ratings agency Moody’s has cautioned that the private credit industry is about to face its “first serious challenge”[6] as tens of billions worth of loans extended at the market’s peak in 2021 – when interest rates were still close to zero – are strained by economic headwinds and uncertainty along with the lack of guidance on just how long higher-for-longer interest rates will persist. Moody’s also singled out two of the largest companies in the sector – Ares and Owl Rock – as being at risk from rising defaults.

As of July, corporate defaults are already running at their fastest pace in more than a decade for companies with public debt.[7] Though these have not yet made a significant dent on the overall economy, analysts have warned that the strain of rising defaults is mounting, creating a worrying — if still modest — risk of a financial crisis.

This highlights the fact that not all private financing is the same. In times like these, securities-based financing shows its worth. Though facilities need to be structured carefully, in general risks are limited by the capital provider’s ability to recover the securities or crypto provided by the investor to back the financing – and structured as a sale and repurchase agreement. This is also conducive to preserving systemic financial stability.

Structuring deals in this way has helped EquitiesFirst grow sustainably for 20 years – meeting investors’ needs in both buoyant and rocky markets.

[1] https://www.ft.com/content/110bd237-cbf2-463d-b1b5-edcb98245851

[2] https://www.forbes.com/sites/rohitarora/2023/07/26/fed-raises-interest-rates-to-22-year-high-credit-crunch-continues-for-small-businesses/?sh=4b3afef75b21

[3] https://www.reuters.com/business/finance/asias-private-credit-markets-thrive-desperate-borrowers-find-lenders-2023-07-20/

[4] https://www.kkr.com/global-perspectives/publications/asset-based-finance-fast-growing-frontier-private-credit

[5] https://www.kkr.com/global-perspectives/publications/asset-based-finance-fast-growing-frontier-private-credit

[6] https://www-ft-com.ezp.lib.cam.ac.uk/content/de6eb245-80ff-4f9c-b2ed-7a415538512b

[7] https://www.nytimes.com/2023/07/26/business/credit-markets-uncertainty-interest-rates.html

إخلاء مسؤولية

أعدت هذه الوثيقة خصيصاً للمستثمرين المعتمدين أو المستثمرين المتطورين ماليًّا أو المستثمرين المحترفين أو المستثمرين المؤهلين، على النحو الذي يقتضيه القانون أو غيره، وهي ليست موجهة للأشخاص الذين لا يستوفون المتطلبات ذات الصلة وينبغي عدم استخدامها من أجلهم. يستخدم محتوى هذه الوثيقة لأغراض إعلامية فقط ويغلب عليه الطابع العام ولا يلبي أي غاية محددة أو حاجة مالية معينة. تخص وجهات النظر والآراء الواردة في هذه الوثيقة أطرافًا ثالثة ولا تعكس بالضرورة وجهات نظر شركة “إيكويتيز فيرست” أو آراءها. لم تفحص شركة “إيكويتيز فيرست” المعلومات الواردة في هذه الوثيقة أو لم تتحقق منها بشكل مستقل، ولا تقدم أي تعهد بمدى دقتها أو اكتمالها. تخضع الآراء والمعلومات الواردة في هذه الوثيقة للتغيير من دون إشعار. لا يمثل محتوى الوثيقة عرضًا لبيع (أو طلب عرض شراء) أي أوراق مالية أو استثمارات أو منتجات مالية (يشار إليها باسم “العرض”). يجب تقديم أي عرض مماثل لذلك فقط من خلال عرض ذي صلة أو وثائق أخرى تحدد شروطه وأحكامه المادية. لا يشكل أي محتوى وارد في هذه الوثيقة توصية أو طلبًا أو دعوة أو إغراء أو ترويجًا أو عرضًا لشراء أو بيع أي منتج استثماري من شركة “إيكويتيز فيرست” أو “إيكويتيز فيرست هولدينجز المحدودة” أو الشركات التابعة لها (يشار إليها مجتمعة باسم “إيكويتيز فيرست”)، ولا يجوز تفسير هذه الوثيقة بأي شكل من الأشكال على أنها مشورة استثمارية أو قانونية أو ضريبية أو توصية أو مرجع أو إقرار مقدم من شركة “إيكويتيز فيرست”. وعليك طلب المشورة المالية المستقلة قبل اتخاذ أي قرار استثماري بشأن منتج مالي معين.

تحتفظ هذه الوثيقة بحقوق الملكية الفكرية لشركة “إيكويتيز فيرست” في الولايات المتحدة ودول أخرى، ويشمل ذلك على سبيل المثال لا الحصر، الشعارات الخاصة بها وغيرها من العلامات التجارية وعلامات الخدمة المسجلة وغير المسجلة. تحتفظ الشركة بجميع الحقوق المتعلقة بملكيتها الفكرية الواردة في هذه الوثيقة. ينبغي لمستلمي هذه الوثيقة عدم توزيعها أو نشرها أو إعادة إنتاجها أو إتاحتها كليًّا أو جزئيًّا بأي شكل من الأشكال لأي شخص آخر، لا سيما الأشخاص في دولة قد يؤدي توزيع هذه الوثيقة فيها إلى خرق أي شرط قانوني أو تنظيمي.

لا تقدم شركة “إيكويتيز فيرست” أي تعهد أو ضمان فيما يتعلق بهذه الوثيقة، وتخلي مسؤوليتها صراحة عن أي ضمان ضمني بموجب القانون. وعليه تقر بأن شركة “إيكويتيز فيرست” ليست مسؤولة تحت أي ظرف من الظروف عن أي أضرار مباشرة أو غير مباشرة أو خاصة أو تبعية أو عرضية أو عقابية أيًّا كان نوعها، منها على سبيل المثال لا الحصر، أي أرباح مفقودة أو فرص ضائعة، حتى إذا تم إخطار الشركة بإمكانية وقوع مثل هذه الأضرار.

تدلي شركة “إيكويتيز فيرست” بالتصريحات الإضافية الآتية التي قد تطبق في دول الاختصاص القضائي المذكورة:

دبي: تخضع شركة “إيكويتيز فيرست هونج كونج المحدودة” (التي يشار إليها باسم “المكتب التمثيلي بمركز دبي المالي العالمي”) الكائنة في مبنى حي البوابة 4، الطابق 6، المكتب 7، مركز دبي المالي العالمي (التي تحمل ترخيصًا تجاريًّا رقم CL7354) للوائح سلطة دبي للخدمات المالية بصفتها مكتبًّا تمثيليًّا (رقم مرجع الشركة لدى سلطة دبي للخدمات المالية:F008752 ). جميع الحقوق محفوظة.

تعد المعلومات الواردة في هذه الوثيقة عامة بطبيعتها، وإذا نُظر إليها على أنها مشورة، فإن أي مشورة واردة هنا عامة وقد تم إعدادها من دون النظر إلى أهدافك أو وضعك المالي أو ملاءمة منتجاتك المالية أو احتياجاتك.

تُستخدم المواد الواردة في هذه الوثيقة لأغراض معلوماتية فقط وينبغي عدم تفسيرها على أنها مشورة مالية أو عرض أو طلب أو توصية لشراء منتجات مالية أو بيعها. تعد المعلومات الواردة في هذه الوثيقة عامة بطبيعتها، وأي مشورة واردة هنا هي عامة وقد تم إعدادها من دون النظر إلى أهدافك أو وضعك المالي أو ملاءمة منتجاتك المالية أو احتياجاتك. لذا قبل استخدام أي من هذه المعلومات، يجب أن تفكر في مدى ملاءمتها لأهدافك ووضعك المالي واحتياجاتك وطبيعة المنتج المالي ذي الصلة. يمكنك استشارة مستشار مالي معتمد إذا لم تكن بعض محتويات هذه الوثيقة واضحة بالنسبة إليك.

تختص هذه الوثيقة بمنتج مالي لا يخضع لأي شكل من أشكال التنظيم أو الاعتماد الخاص بسلطة دبي للخدمات المالية. لا تتحمل سلطة دبي للخدمات المالية أي مسؤولية عن مراجعة أي وثائق تتعلق بهذا المنتج المالي أو التحقق منها. وعليه، لم تعتمد سلطة دبي للخدمات المالية هذه الوثيقة أو أي وثائق أخرى مرتبطة بها ولم تتخذ أي خطوات للتحقق من المعلومات الواردة فيها، ولا تتحمل أي مسؤولية ناجمة عنها.

أستراليا: تحمل شركة “إيكويتيز فيرست هولدينجز (أستراليا) ذات المسؤولية المحدودة” (رقم الشركة في أستراليا: 399 644 142) ترخيصًا لمزاولة الخدمات المالية في أستراليا (رقم الترخيص: 387079). جميع الحقوق محفوظة.

توجه المعلومات الواردة في هذه الوثيقة للأشخاص في أستراليا فقط المصنفين بأنهم عملاء في قطاع التجارة بالجملة على النحو المحدد في القسم 761G من قانون الشركات لعام 2001. قد يُقيد توزيع المعلومات على الأشخاص الذين لا تنطبق عليهم هذه المعايير بموجب القانون، ويجب على الأشخاص الذين يمتلكونها طلب المشورة ومراعاة أي قيود تتعلق بها.

تستخدم المواد الواردة في هذه الوثيقة لأغراض معلوماتية فقط وينبغي عدم تفسيرها على أنها عرض أو طلب أو توصية لشراء منتجات مالية أو بيعها.

تُعد المعلومات الواردة في هذه الوثيقة عامة بطبيعتها وليست مشورة شخصية بشأن المنتجات المالية. أي مشورة واردة في الوثيقة هي عامة فقط وقد تم إعدادها من دون النظر إلى أهدافك أو وضعك المالي أو احتياجاتك. لذا قبل استخدام أي من هذه المعلومات، يجب أن تفكر في مدى ملاءمتها لأهدافك ووضعك المالي واحتياجاتك وطبيعة المنتج المالي ذي الصلة. عليك طلب المشورة المالية المستقلة وقراءة بيانات الإفصاح ذات الصلة أو وثائق العرض الأخرى قبل اتخاذ أي قرار استثماري بشأن منتج مالي معين.

هونغ كونغ: تمتلك شركة “إيكويتيز فيرست هولدينجز هونج كونج المحدودة” ترخيصًا من النوع 1 من لجنة هونغ كونغ للأوراق المالية والعقود الآجلة، وهي مرخصة في هونغ كونغ بموجب قانون مقرضي الأموال (ترخيص مقرض الأموال رقم 2024/1659). لم تراجع لجنة هونغ كونغ للأوراق المالية والعقود الآجلة هذه الوثيقة. لا تمثل هذه الوثيقة عرضًا لبيع أوراق مالية أو طلبًا لشراء أي منتج تديره أو تقدمه شركة “إيكويتيز فيرست هولدينجز هونج كونج المحدودة”، لكنها موجهة للمستثمرين المحترفين لا للأفراد أو المؤسسات التي تكون هذه العروض أو الدعوات غير قانونية أو محظورة بالنسبة إليهم.

كوريا: توجه هذه الوثيقة فقط للمستهلكين الماليين المحترفين أو المستثمرين المحترفين أو المستثمرين المؤهلين الذين يتسلحون بالمعرفة ويتمتعون بالخبرة الكافية للدخول في معاملات تمويل الأوراق المالية، وهي غير مخصصة للأشخاص الذين لا يستوفون هذه المعايير وينبغي عدم استخدامهم إياها.

المملكة المتحدة: “إيكويتيز فيرست (لندن) المحدودة” هي شركة مرخصة وتخضع لرقابة هيئة الإدارة المالية البريطانية (FCA) في المملكة المتحدة. توزع هذه الوثيقة في المملكة المتحدة وتتاح فقط لفئات الأشخاص المذكورين في المادة 19 (5) (محترفي الاستثمار) والمادة 49 (2) (الشركات ذات الأرصدة المالية الضخمة وجمعيات الأفراد وغيرها) من الجزء الرابع من مرسوم الترويج المالي (FPO) لعام 2005 التابع لقانون الخدمات والأسواق المالية لعام 2000، وأي نشاط استثماري يتعلق بهذا العرض متاح فقط لهؤلاء الأشخاص، ولا يشارك فيه سواهم. يجب على الأشخاص الذين ليست لديهم خبرة مهنية في أمور الاستثمار أو من لا تنطبق عليهم المادة 49 من مرسوم الترويج المالي عدم الاعتماد على هذه الوثيقة؛ لأنها أعدت فقط للأشخاص المؤهلين بوصفهم مستثمرين محترفين بموجب توجيه الأسواق في الأدوات المالية (MiFID) وهي متاحة لهم.© حقوق الطبع والنشر لعام 2024 محفوظة لصالح شركة إيكويتيز فيرست هولدينجز هونج كونج المحدودة. جميع الحقوق محفوظة.