Enhanced risk management for a safer financial system

EquitiesFirst shares global regulators’ commitment to protecting the financial system against systemic risks as well as corporate scandal and fraud.

The financial crisis of 2008 made it abundantly clear that poor risk management in the financial sector can have a very real impact on livelihoods and businesses in the real economy.

The collapse of the US sub-prime mortgage market, followed by the fallout from the bankruptcy of Lehman Brothers, triggered a global recession. Americans alone lost US$9.8 trillion of wealth in the crash and the recession caused a loss of nearly 4% of global Gross Domestic Product, according to Moody’s Analytics.[1]

More recently, the build-up of debt in the Chinese property sector has captured global attention. Investment bank Nomura estimates that China’s developers have total debts worth US$5.2 trillion, with nearly half of that amount made up of bank loans.[2]

Globally, a determination to guard against a repeat of the 2008 crisis and rebuild trust in the financial system has led to an ongoing focus on reducing risk. But episodes from Wirecard to Archegos and Evergrande have shown that the world is never far away from another financial scandal.

To protect the financial system and the real economy it serves, regulators globally have stepped up their monitoring of financial risks and taken action to prevent risk from building up across the system or in specific pockets.

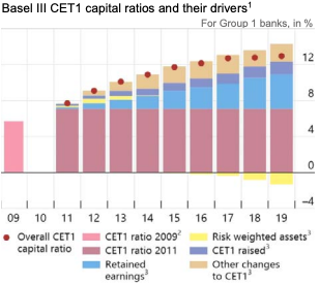

One of the biggest post-2008 changes requires banks to hold more capital in reserve for every dollar they lend, reducing the risk that another bank will fail or need bailing out with taxpayers’ money.

The so-called Basel reforms led to core equity tier 1 (CET1) capital ratios for large international banks increasing by nearly 3% between 2013 and 2019, according to the Financial Stability Board (See Chart)[3]. Experts believe that these stronger capital buffers helped ensure the stability of the banking system as the Covid-19 pandemic emerged in early 2020.

Trust and integrity

Following scandals over the manipulation of key interest and foreign exchange rates, benchmark lending rates are also being reformed to make them more transparent. This has resulted in the phasing-out of Libor – the most widely used reference for floating-rate loans – from the end of 2021.

Furthermore, companies and individuals must now pass more stringent know-your-client processes before being onboarded by financial institutions. This enhanced scrutiny is intended to protect the integrity of the financial systems by preventing money-laundering, sanctions evasion and the terrorist financing.

This heightened focus on risk management has underpinned a recovery from the recession of 2008. However, the loss of public trust caused by the Global Financial Crisis must be fully reversed for the financial sector to fulfill its purpose of converting savings into productive economic activity.

Indeed, the Organisation for Economic Cooperation and Development (OECD) noted in 2019 that market integrity, transparency and sound oversight are important drivers of restoring faith in the financial system. “The behaviour of institutions and participants in markets is critically important to maintaining society’s trust in markets, and forms a distinct component of investor confidence,” it said.[4]

A long-term partner

At EquitiesFirst, integrity and robust risk management is at the heart of our business.

We operate in global financial centers including the UK, Hong Kong and Australia and are subject to stringent regulatory standards. EquitiesFirst and its regional subsidiaries are licensed and regulated across multiple jurisdictions.

We are committed to helping prevent money-laundering, fraud, market manipulation and other forms of illicit activity in the equity markets. Our compliance process begins with a comprehensive onboarding procedure that requires prospective borrowers to provide personal or corporate documentation.

EquitiesFirst’s private ownership also helps to safeguard the stability of our capital. We do not rely on external financing or credit lines that could be withdrawn in times of crisis, nor do we manage capital for external investors.

We have also invested in our own in-house research capabilities to help ensure full vetting of every opportunity and careful collateral management. We only lend against shares after a thorough fundamental and technical analysis, and we run a diversified portfolio across sectors and geographies to mitigate broader market risks.

Financial markets will always have periods of volatility, but we believe robust risk management, at the macroeconomic and institutional level, will help ensure stability and orderly markets even during difficult times. This is a priority for regulators around the world – and for EquitiesFirst.

[1] https://www.washingtonpost.com/business/economy/a-guide-to-the-financial-crisis–10-years-later/2018/09/10/114b76ba-af10-11e8-a20b-5f4f84429666_story.html

[2] https://www.wsj.com/articles/beyond-evergrande-chinas-property-market-faces-a-5-trillion-reckoning-11633882048#:~:text=Nomura%20estimated%20that%20as%20of,many%20of%20them%20junk%2Drated.

[3] https://www.fsb.org/wp-content/uploads/P130721.pdf

[4] https://www.oecd-ilibrary.org/finance-and-investment/oecd-business-and-finance-outlook-2019_af784794-en

إخلاء مسؤولية

أعدت هذه الوثيقة خصيصاً للمستثمرين المعتمدين أو المستثمرين المتطورين ماليًّا أو المستثمرين المحترفين أو المستثمرين المؤهلين، على النحو الذي يقتضيه القانون أو غيره، وهي ليست موجهة للأشخاص الذين لا يستوفون المتطلبات ذات الصلة وينبغي عدم استخدامها من أجلهم. يستخدم محتوى هذه الوثيقة لأغراض إعلامية فقط ويغلب عليه الطابع العام ولا يلبي أي غاية محددة أو حاجة مالية معينة. تخص وجهات النظر والآراء الواردة في هذه الوثيقة أطرافًا ثالثة ولا تعكس بالضرورة وجهات نظر شركة “إيكويتيز فيرست” أو آراءها. لم تفحص شركة “إيكويتيز فيرست” المعلومات الواردة في هذه الوثيقة أو لم تتحقق منها بشكل مستقل، ولا تقدم أي تعهد بمدى دقتها أو اكتمالها. تخضع الآراء والمعلومات الواردة في هذه الوثيقة للتغيير من دون إشعار. لا يمثل محتوى الوثيقة عرضًا لبيع (أو طلب عرض شراء) أي أوراق مالية أو استثمارات أو منتجات مالية (يشار إليها باسم “العرض”). يجب تقديم أي عرض مماثل لذلك فقط من خلال عرض ذي صلة أو وثائق أخرى تحدد شروطه وأحكامه المادية. لا يشكل أي محتوى وارد في هذه الوثيقة توصية أو طلبًا أو دعوة أو إغراء أو ترويجًا أو عرضًا لشراء أو بيع أي منتج استثماري من شركة “إيكويتيز فيرست” أو “إيكويتيز فيرست هولدينجز المحدودة” أو الشركات التابعة لها (يشار إليها مجتمعة باسم “إيكويتيز فيرست”)، ولا يجوز تفسير هذه الوثيقة بأي شكل من الأشكال على أنها مشورة استثمارية أو قانونية أو ضريبية أو توصية أو مرجع أو إقرار مقدم من شركة “إيكويتيز فيرست”. وعليك طلب المشورة المالية المستقلة قبل اتخاذ أي قرار استثماري بشأن منتج مالي معين.

تحتفظ هذه الوثيقة بحقوق الملكية الفكرية لشركة “إيكويتيز فيرست” في الولايات المتحدة ودول أخرى، ويشمل ذلك على سبيل المثال لا الحصر، الشعارات الخاصة بها وغيرها من العلامات التجارية وعلامات الخدمة المسجلة وغير المسجلة. تحتفظ الشركة بجميع الحقوق المتعلقة بملكيتها الفكرية الواردة في هذه الوثيقة. ينبغي لمستلمي هذه الوثيقة عدم توزيعها أو نشرها أو إعادة إنتاجها أو إتاحتها كليًّا أو جزئيًّا بأي شكل من الأشكال لأي شخص آخر، لا سيما الأشخاص في دولة قد يؤدي توزيع هذه الوثيقة فيها إلى خرق أي شرط قانوني أو تنظيمي.

لا تقدم شركة “إيكويتيز فيرست” أي تعهد أو ضمان فيما يتعلق بهذه الوثيقة، وتخلي مسؤوليتها صراحة عن أي ضمان ضمني بموجب القانون. وعليه تقر بأن شركة “إيكويتيز فيرست” ليست مسؤولة تحت أي ظرف من الظروف عن أي أضرار مباشرة أو غير مباشرة أو خاصة أو تبعية أو عرضية أو عقابية أيًّا كان نوعها، منها على سبيل المثال لا الحصر، أي أرباح مفقودة أو فرص ضائعة، حتى إذا تم إخطار الشركة بإمكانية وقوع مثل هذه الأضرار.

تدلي شركة “إيكويتيز فيرست” بالتصريحات الإضافية الآتية التي قد تطبق في دول الاختصاص القضائي المذكورة:

دبي: تخضع شركة “إيكويتيز فيرست هونج كونج المحدودة” (التي يشار إليها باسم “المكتب التمثيلي بمركز دبي المالي العالمي”) الكائنة في مبنى حي البوابة 4، الطابق 6، المكتب 7، مركز دبي المالي العالمي (التي تحمل ترخيصًا تجاريًّا رقم CL7354) للوائح سلطة دبي للخدمات المالية بصفتها مكتبًّا تمثيليًّا (رقم مرجع الشركة لدى سلطة دبي للخدمات المالية:F008752 ). جميع الحقوق محفوظة.

تعد المعلومات الواردة في هذه الوثيقة عامة بطبيعتها، وإذا نُظر إليها على أنها مشورة، فإن أي مشورة واردة هنا عامة وقد تم إعدادها من دون النظر إلى أهدافك أو وضعك المالي أو ملاءمة منتجاتك المالية أو احتياجاتك.

تُستخدم المواد الواردة في هذه الوثيقة لأغراض معلوماتية فقط وينبغي عدم تفسيرها على أنها مشورة مالية أو عرض أو طلب أو توصية لشراء منتجات مالية أو بيعها. تعد المعلومات الواردة في هذه الوثيقة عامة بطبيعتها، وأي مشورة واردة هنا هي عامة وقد تم إعدادها من دون النظر إلى أهدافك أو وضعك المالي أو ملاءمة منتجاتك المالية أو احتياجاتك. لذا قبل استخدام أي من هذه المعلومات، يجب أن تفكر في مدى ملاءمتها لأهدافك ووضعك المالي واحتياجاتك وطبيعة المنتج المالي ذي الصلة. يمكنك استشارة مستشار مالي معتمد إذا لم تكن بعض محتويات هذه الوثيقة واضحة بالنسبة إليك.

تختص هذه الوثيقة بمنتج مالي لا يخضع لأي شكل من أشكال التنظيم أو الاعتماد الخاص بسلطة دبي للخدمات المالية. لا تتحمل سلطة دبي للخدمات المالية أي مسؤولية عن مراجعة أي وثائق تتعلق بهذا المنتج المالي أو التحقق منها. وعليه، لم تعتمد سلطة دبي للخدمات المالية هذه الوثيقة أو أي وثائق أخرى مرتبطة بها ولم تتخذ أي خطوات للتحقق من المعلومات الواردة فيها، ولا تتحمل أي مسؤولية ناجمة عنها.

أستراليا: تحمل شركة “إيكويتيز فيرست هولدينجز (أستراليا) ذات المسؤولية المحدودة” (رقم الشركة في أستراليا: 399 644 142) ترخيصًا لمزاولة الخدمات المالية في أستراليا (رقم الترخيص: 387079). جميع الحقوق محفوظة.

توجه المعلومات الواردة في هذه الوثيقة للأشخاص في أستراليا فقط المصنفين بأنهم عملاء في قطاع التجارة بالجملة على النحو المحدد في القسم 761G من قانون الشركات لعام 2001. قد يُقيد توزيع المعلومات على الأشخاص الذين لا تنطبق عليهم هذه المعايير بموجب القانون، ويجب على الأشخاص الذين يمتلكونها طلب المشورة ومراعاة أي قيود تتعلق بها.

تستخدم المواد الواردة في هذه الوثيقة لأغراض معلوماتية فقط وينبغي عدم تفسيرها على أنها عرض أو طلب أو توصية لشراء منتجات مالية أو بيعها.

تُعد المعلومات الواردة في هذه الوثيقة عامة بطبيعتها وليست مشورة شخصية بشأن المنتجات المالية. أي مشورة واردة في الوثيقة هي عامة فقط وقد تم إعدادها من دون النظر إلى أهدافك أو وضعك المالي أو احتياجاتك. لذا قبل استخدام أي من هذه المعلومات، يجب أن تفكر في مدى ملاءمتها لأهدافك ووضعك المالي واحتياجاتك وطبيعة المنتج المالي ذي الصلة. عليك طلب المشورة المالية المستقلة وقراءة بيانات الإفصاح ذات الصلة أو وثائق العرض الأخرى قبل اتخاذ أي قرار استثماري بشأن منتج مالي معين.

هونغ كونغ: تمتلك شركة “إيكويتيز فيرست هولدينجز هونج كونج المحدودة” ترخيصًا من النوع 1 من لجنة هونغ كونغ للأوراق المالية والعقود الآجلة، وهي مرخصة في هونغ كونغ بموجب قانون مقرضي الأموال (ترخيص مقرض الأموال رقم 2024/1659). لم تراجع لجنة هونغ كونغ للأوراق المالية والعقود الآجلة هذه الوثيقة. لا تمثل هذه الوثيقة عرضًا لبيع أوراق مالية أو طلبًا لشراء أي منتج تديره أو تقدمه شركة “إيكويتيز فيرست هولدينجز هونج كونج المحدودة”، لكنها موجهة للمستثمرين المحترفين لا للأفراد أو المؤسسات التي تكون هذه العروض أو الدعوات غير قانونية أو محظورة بالنسبة إليهم.

كوريا: توجه هذه الوثيقة فقط للمستهلكين الماليين المحترفين أو المستثمرين المحترفين أو المستثمرين المؤهلين الذين يتسلحون بالمعرفة ويتمتعون بالخبرة الكافية للدخول في معاملات تمويل الأوراق المالية، وهي غير مخصصة للأشخاص الذين لا يستوفون هذه المعايير وينبغي عدم استخدامهم إياها.

المملكة المتحدة: “إيكويتيز فيرست (لندن) المحدودة” هي شركة مرخصة وتخضع لرقابة هيئة الإدارة المالية البريطانية (FCA) في المملكة المتحدة. توزع هذه الوثيقة في المملكة المتحدة وتتاح فقط لفئات الأشخاص المذكورين في المادة 19 (5) (محترفي الاستثمار) والمادة 49 (2) (الشركات ذات الأرصدة المالية الضخمة وجمعيات الأفراد وغيرها) من الجزء الرابع من مرسوم الترويج المالي (FPO) لعام 2005 التابع لقانون الخدمات والأسواق المالية لعام 2000، وأي نشاط استثماري يتعلق بهذا العرض متاح فقط لهؤلاء الأشخاص، ولا يشارك فيه سواهم. يجب على الأشخاص الذين ليست لديهم خبرة مهنية في أمور الاستثمار أو من لا تنطبق عليهم المادة 49 من مرسوم الترويج المالي عدم الاعتماد على هذه الوثيقة؛ لأنها أعدت فقط للأشخاص المؤهلين بوصفهم مستثمرين محترفين بموجب توجيه الأسواق في الأدوات المالية (MiFID) وهي متاحة لهم.© حقوق الطبع والنشر لعام 2024 محفوظة لصالح شركة إيكويتيز فيرست هولدينجز هونج كونج المحدودة. جميع الحقوق محفوظة.