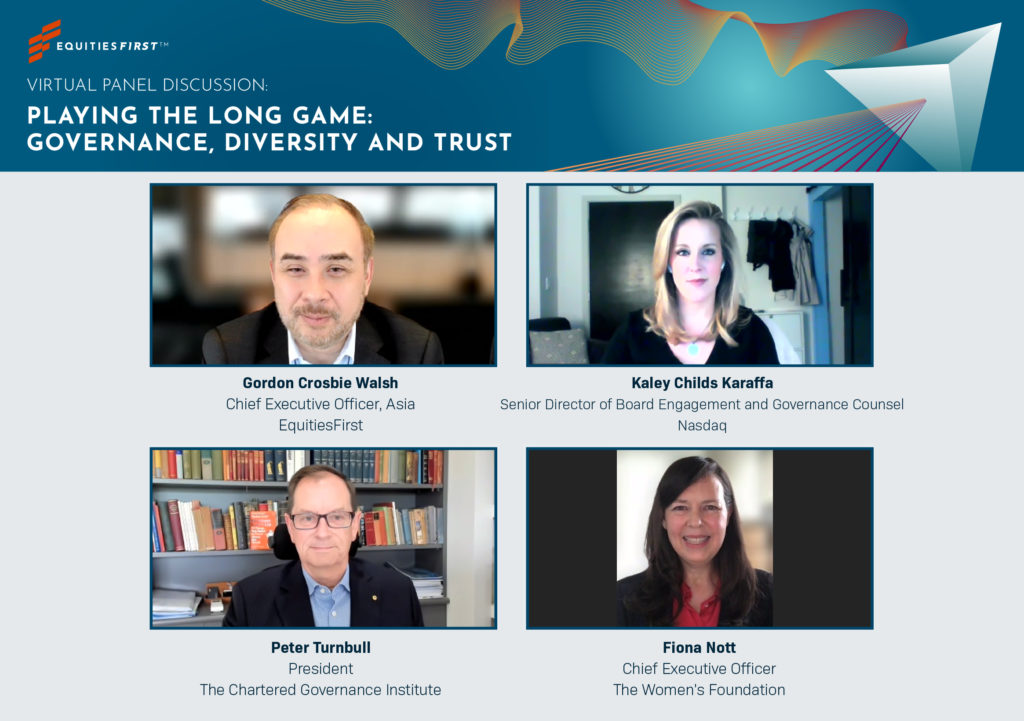

(Hong Kong, 29 December 2021) – Equities First Holdings, LLC, (“EquitiesFirst”), a global specialist in asset-backed financing, and Nasdaq Governance Solutions, jointly hosted a webinar “Playing the Long Game – Governance, Diversity and Trust”, convening regional business leaders across Asia Pacific to discuss corporate governance issues integral to long-term business performance.

In attendance were industry experts including Kaley Childs Karaffa, Senior Director of Board Engagement and Governance Counsel, Nasdaq; Fiona Nott, CEO, The Women’s Foundation; Peter Turnbull, President, The Chartered Governance Institute; and Gordon Crosbie-Walsh, Asia CEO, EquitiesFirst.

The panel aimed to add value to investors and management by highlighting the utility of corporate governance in bringing more support for capital operations and enhancing future financial capacity. By addressing board diversity and composition, stronger accountability, and future considerations for corporations of all sizes, the meeting evaluated the implementation of good corporate governance for organisational growth.

Despite the wide range of geographies, the group agreed good corporate governance translated to more agile performance and better positioning against other participants within the market. A study from New York University Stern School of Business mentioned in the webinar indicated that companies with good governance programs outperformed by 6% compared to those with little to no enforcement, which underperformed the market by 3-4%.

Peter Turnbull of The Chartered Governance Institute highlighted that “Good governance is simply about operating a firm in a logical, accountable and risk-managed way that creates a bedrock for smooth operations.” In terms of practicality, he urged enterprises to adopt a streamlined four-pillar model of good governance consisting of transparency, accountability, fairness and equity and responsibility.

Gordon Crosbie-Walsh of EquitiesFirst commented that many Asia Pacific markets exceeded expectations and made significant progress towards good governance measures. He emphasised that there were still areas for improvement, with board and management diversity in Hong Kong being an example.

Fiona Nott of The Women’s Foundation revealed that only 14.3% of Hong Kong Hang Seng Index Board’s directorships were held by women, noting that Hong Kong continues to be outpaced by other global financial centres such as Australia, the UK and the US which all have 30% and above female representation. Neighbouring economies including Malaysia, Singapore and India have also surpassed Hong Kong. Bolder reform is needed for meaningful change, including board gender diversity targets, which if not met, should be mandated through quotas.

The concluding tone was largely optimistic towards more diverse elements such as a balanced ratio for both genders in the boardroom. The consensus was that ESG practices are seeing a strong flow of macro-investment, with recent Bank of America figures showing that potentially up to three dollars in every ten invested in 2021 had some form of ESG filter attached.

The virtual panel completed the 2021 strategic partnership between EquitiesFirst and Nasdaq Governance Solutions and sparked conversations on best governance practices across Asia Pacific. It resulted in active participation from industry-wide organisations. The partnership also identified a requirement for awareness within the region to sustain initiatives that link operational targets with good corporate governance whilst also strengthening company culture and addressing workforce expectations.

Since May 2021, EquitiesFirst and Nasdaq Governance Solutions have partnered to develop a series of co-branded whitepapers to navigate corporate governance with succinct research and holistic evaluations that go beyond a surface-level understanding. Several reports were published with local experts on selected markets, including Japan, Australia, Hong Kong, China, South Korea, Malaysia, Singapore, Thailand and India, to provide background and critical insights on the space. Nasdaq Governance Solutions contributed to the development of the Japan, Australia, Hong Kong, and India reports. The reports are now all available at www.equitiesfirst.com/int/corpgov/.

***

Media Enquiries:

Juliana Ng, EquitiesFirst

+852-3958-4512 | jng@equitiesfirst.com

Winky Chow, Ruder Finn

+852-2201-6474 | choww@ruderfinnasia.com

About Equities First Holdings

Founded in 2002, EquitiesFirst is a global investor specializing in long-term asset-backed financing. EquitiesFirst’s approach overcomes traditional limitations and redefines the financing experience through providing efficient access to capital for listed companies, entrepreneurs and investors against publicly traded securities. The total value of loans transacted stands at US$2.5 billion as of 1 December 2020.

Headquartered in Indianapolis, USA, EquitiesFirst maintains an international footprint of twelve offices in eight countries, including the United States, United Kingdom, Spain, China, South Korea, Thailand, Singapore and Australia. EquitiesFirst is appropriately licensed and/or registered in all jurisdictions.

EquitiesFirst is the pioneer of Progressive Capital – a partnership approach to investment, rooted in respect, mutual interest and understanding. EquitiesFirst delivers liquidity solutions that are vital, transformative and move partners forward.

For more information, please visit www.equitiesfirst.com/.

Disclaimer

This Document is intended solely for accredited investors, sophisticated investors, professional investors, or otherwise qualified investors, as may be required by law or otherwise, and it is not intended for, and should not be used by, persons who do not meet the relevant requirements. The content provided herein is for informational purposes only and is general in nature and not targeted to any specific objective or financial need. The views and opinions expressed in this Document have been prepared by third parties and do not necessarily reflect the views and opinions of EquitiesFirst. EquitiesFirst has not independently examined or verified the information provided herein, and no representation is made that it is accurate or complete. Opinions and information herein are subject to change without notice. The content provided does not constitute an offer to sell (or solicitation of an offer to purchase) any securities, investments, or any financial products (“Offer”). Any such Offer shall only be made through a relevant offering or other documentation which sets forth its material terms and conditions. Nothing contained in this Document shall constitute a recommendation, solicitation, invitation, inducement, promotion, or offer for the purchase or sale of any investment product by Equities First Holdings, LLC or its subsidiaries (collectively, “EquitiesFirst”), nor shall this Document be construed in any way as investment, legal, or tax advice, or as a recommendation, reference, or endorsement by EquitiesFirst. You should seek independent financial advice prior to making an investment decision about a financial product.

This Document contains the intellectual property of EquitiesFirst in the United States and other countries, including, without limitation, their respective logos and other registered and unregistered trademarks and service marks. EquitiesFirst reserves all rights in and to their intellectual property contained in this Document. The Document should not be distributed, published, reproduced or otherwise made available in whole or in part by recipients to any other person and, in particular, should not be distributed to persons in any country where such distribution may lead to a breach of any legal or regulatory requirement.

EquitiesFirst make no representation or warranty with respect to this Document and expressly disclaim any implied warranty under law. You acknowledge that EquitiesFirst is not liable under any circumstances for any direct, indirect, special, consequential, incidental, or punitive damages whatsoever, including, without limitation, any lost profits or lost opportunity, even if EquitiesFirst has been advised of the possibility of such damages.

©2021 Equities First Holdings Hong Kong Limited. All rights reserved