The advent of costly capital calls for a progressive solution

The market volatility that followed the abrupt end to a decade of ultra-low interest rates has made it clear that interest rates are a major driver of equity market performance. Having been forced to adjust their valuations and growth expectations over the past year, investors need to assess how a structurally higher cost of capital will affect their portfolio strategies in the longer term.

With US interest rates at their highest for 16 years after a rapid succession of hikes, the billion-dollar question for equity investors is how the battle against persistently high inflation will affect corporate earnings and economic growth around the world.

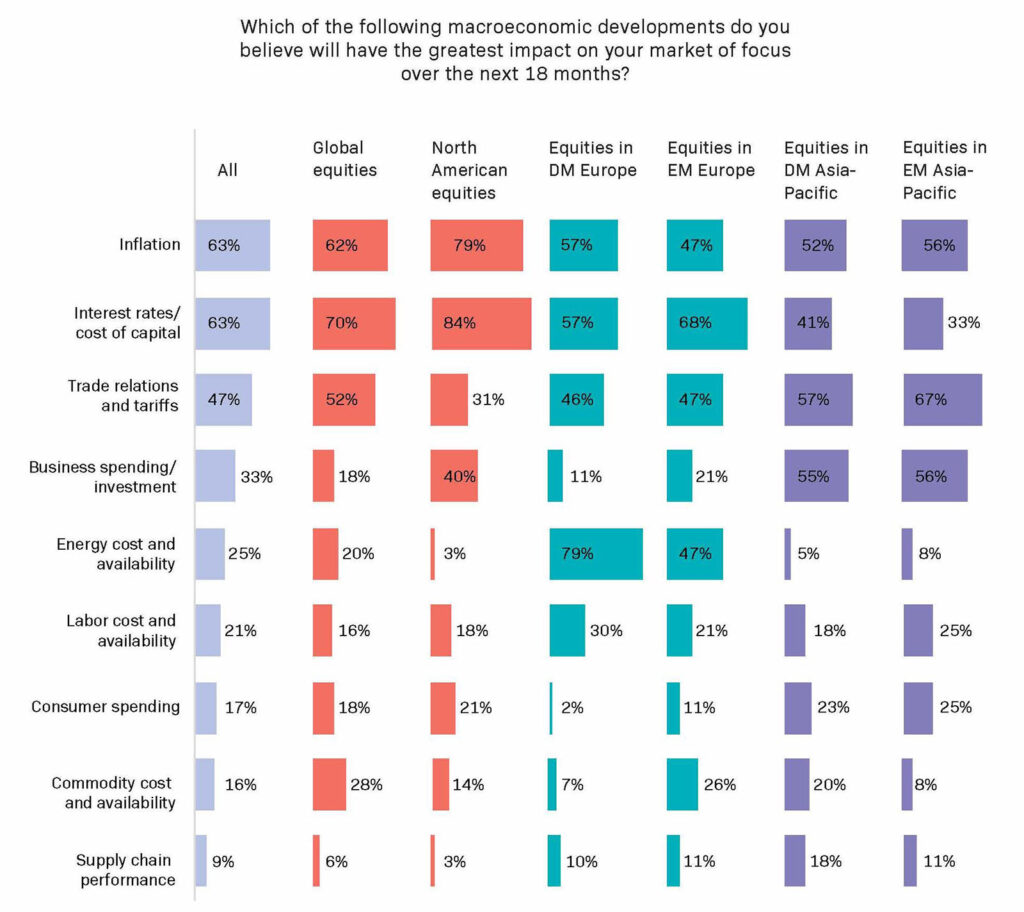

Nearly two-thirds of investors see inflation and interest rates as the macroeconomic factors with the greatest bearing on stock market performance over the next 18 months, according to a new study commissioned by EquitiesFirst and carried out by Institutional Investor. The general consensus is that rate rises are at or close to peaking, but there is certainly room for more surprises.

While markets are looking for cuts to support a slowing economy, policymakers in the US and Europe have warned that interest rates are likely to remain elevated until at least 2024, given that inflation is still well above their target range.[1]

The longer rates remain high, the more business and household borrowers will feel the squeeze from higher borrowing costs. This credit tightening has accelerated in recent months as lenders turn more cautious ahead of an expected recession and look to conserve their own liquidity. More than US$1.1 trillion of deposits have flowed out of US banks since the Fed began its hiking cycle in March 2022.[2]

Defaults on the rise

The EquitiesFirst study – which polled some 300 investment decision-makers across asset management firms, foundations, pension schemes and endowments – shows that the higher cost of capital is casting a cloud over investor sentiment.

Indeed, it could very well trigger the recession that the market has been predicting. Analysts at Deutsche Bank at the start of June argued that a wave of credit defaults is imminent, now that the combination of higher interest rates and tighter lending standards has put an end to a two-decade lending boom fueled by ultra-cheap money.[3] US high-yield bond defaults have risen to 2.1% from 1.1% last year, and loan defaults are up to 3.1% from 1.4% last year. The investment bank sees these peaking at 9% and 11.3%, respectively.[4]

When interest rates were close to zero, even financially stressed firms were able to raise debt and equity capital to continue operating. Now these companies – along with those that are relatively healthy but highly leveraged – may be unable to refinance maturing debt. Accordingly, the number of US businesses filing for bankruptcy is rising fast.[5]

The housing market, meanwhile, could be another casualty of the sharp rise in capital costs, with home prices tipped by some to fall as much as 10-15% this year.[6] Pricier mortgages mean not only that property owners may struggle to repay their debt but also have less disposable income to spend on other things.

All this could wreak havoc on financial markets, especially if leveraged positions need to be unwound quickly, giving investors plenty to think about for the rest of 2023.

Those who choose to stay invested in public markets are also facing higher margin costs and persistent volatility, while bargain-hunters will find it harder to access the capital they need to fund their purchases.

Tackling the capital crunch

With traditional lenders beating a hasty retreat, many borrowers are turning to private credit –financing from non-bank institutions such as asset managers or pension funds.

As investors have been increasing their allocations to private markets generally in recent years, private credit has become one of the fastest-growing asset classes. Private credit assets under management globally surged from US$342 billion in 2011 to US$1.4 trillion last year[7] and are expected to reach US$2.3 trillion by 2027.

Among the various forms of private credit, securities-backed financing is particularly well suited to today’s more volatile and uncertain market conditions. It typically offers lower borrowing costs than unsecured borrowing, and it is flexible, as virtually any asset – from stocks to cryptocurrencies to real estate – can serve as collateral for funding.

Although loans need to be structured carefully, in general risks are limited by the ability of lenders to recover their collateral, allowing them to offer highly competitive terms and rates.

EquitiesFirst has a 20-year track record in providing such financing – which we call ‘progressive capital’. As partners to long-term shareholders, we offer low-cost, flexible funding to help investors pursue new opportunities while maintaining the upside potential from their underlying holdings.

There are no clear answers to the big questions now facing equity investors, but there are clear opportunities for those who can act decisively in uncertain times and are willing to explore pioneering financing solutions.

[1] https://finance.yahoo.com/news/fed-minutes-rate-cuts-2023-inflation-risk-focus-194814712.html

[2] https://www.euromoney.com/article/2bm0pk1mqx9ldd1tym39c/banking/bank-deposit-flight-and-the-us-money-market-fund-supremacy

[3] https://finance.yahoo.com/news/credit-crunch-spark-wave-corporate-221558407.html

[4] https://finance.yahoo.com/news/credit-crunch-spark-wave-corporate-221558407.html

[5] https://www.ft.com/content/7f45d897-5312-40bd-abff-039ef31c9e50

[6] https://finance.yahoo.com/news/2023-housing-correction-could-largest-165335648.html

[7] MAS, citing Preqin Pro: https://www.mas.gov.sg/news/speeches/2023/private-credit-the-next-key-driver-of-growth-in-private-markets

Disclaimer

Past performance does not guarantee future returns, and individual returns are not guaranteed or warranted.

This Document is intended solely for accredited investors, sophisticated investors, professional investors, or otherwise qualified investors, as may be required by law or otherwise, and it is not intended for, and should not be used by, persons who do not meet the relevant requirements. The content provided herein is for informational purposes only and is general in nature and not targeted to any specific objective or financial need. The views and opinions expressed in this Document have been prepared by third parties and do not necessarily reflect the views and opinions of EquitiesFirst. EquitiesFirst has not independently examined or verified the information provided herein, and no representation is made that it is accurate or complete. Opinions and information herein are subject to change without notice. The content provided does not constitute an offer to sell (or solicitation of an offer to purchase) any securities, investments, or any financial products (“Offer”). Any such Offer shall only be made through a relevant offering or other documentation which sets forth its material terms and conditions. Nothing contained in this Document shall constitute a recommendation, solicitation, invitation, inducement, promotion, or offer for the purchase or sale of any investment product by Equities First Holdings, LLC or its subsidiaries (collectively, “EquitiesFirst”), nor shall this Document be construed in any way as investment, legal, or tax advice, or as a recommendation, reference, or endorsement by EquitiesFirst. You should seek independent financial advice prior to making an investment decision about a financial product.

This Document contains the intellectual property of EquitiesFirst in the United States and other countries, including, without limitation, their respective logos and other registered and unregistered trademarks and service marks. EquitiesFirst reserves all rights in and to their intellectual property contained in this Document. The Document should not be distributed, published, reproduced or otherwise made available in whole or in part by recipients to any other person and, in particular, should not be distributed to persons in any country where such distribution may lead to a breach of any legal or regulatory requirement.

EquitiesFirst make no representation or warranty with respect to this Document and expressly disclaim any implied warranty under law. You acknowledge that EquitiesFirst is not liable under any circumstances for any direct, indirect, special, consequential, incidental, or punitive damages whatsoever, including, without limitation, any lost profits or lost opportunity, even if EquitiesFirst has been advised of the possibility of such damages.

EquitiesFirst makes the following further statements that may be applicable in the stated jurisdiction:

Australia: Equities First Holdings (Australia) Pty Ltd (ACN: 142 644 399) holds an Australian Financial Services Licence (AFSL Number: 387079). All rights reserved.

The information contained on this Document is intended for persons located in Australia only and classified as a Wholesale Client only as defined in Section 761G of the Corporations Act 2001. The distribution of information to persons outside this criteria may be restricted by law and persons who come into possession of it should seek advice and observe any such restriction.

The material contained in this Document is for information purposes only and should not be construed as an offer or solicitation or recommendation to buy or sell financial products.

The information contained in this Document is intended to be general in nature and is not personal financial product advice. Any advice contained in the Document is general advice only and has been prepared without considering your objectives, financial situation or needs. Before acting on any information, you should consider the appropriateness of the information provided and the nature of the relevant financial product having regard to your objectives, financial situation and needs. You should seek independent financial advice and read the relevant disclosure statements or other offer documents prior to making an investment decision about a financial product.

Forecasts are not guaranteed, and undue reliance should not be placed on them. This information is based on views held by Equities First Holdings (Australia) Pty Ltd as at the publishing date of this material.

Dubai: Equities First Holdings Hong Kong Ltd (DIFC Representative Office) at Gate Precinct Building 4, 6th Floor, Office 7, Dubai International Financial Centre (commercial license number CL7354) is regulated by the Dubai Financial Services Authority (“DFSA”) as a Representative Office (DFSA Firm Reference No.: F008752). All rights reserved.

The information contained in this document is intended to be general in nature, and, to the extent that it is perceived as advice, any advice contained in this document is general advice only and has been prepared without considering your objectives, financial situation, suitability of the financial products or your needs.

The material contained in this document is for information purposes only and should not be construed as financial advice, including an offer or solicitation or recommendation to buy or sell financial products. The information contained in this document is intended to be general in nature and any advice contained in this document is general advice only and has been prepared without considering your objectives, financial situation, suitability of the financial products or your needs. Before acting on any information, you should consider the appropriateness of the information provided and the nature of the relevant financial product having regard to your objectives, financial situation and needs. If you do not understand the contents of this document, you should consult an authorised financial adviser.

This document relates to a financial product which is not subject to any form of regulation or approval by the DFSA. The DFSA has no responsibility for reviewing or verifying any documents in connection with this financial product. Accordingly, the DFSA has not approved this document or any other associated documents nor taken any steps to verify the information set out in this document, and has no responsibility for it.

Hong Kong: Equities First Holdings Hong Kong Limited is licensed under the Money Lenders Ordinance (Money Lender’s Licence No. 1659/2024) and to carry on the business of dealing in securities (Type 1 licence) under the Securities and Futures Ordinance (“SFO”) (CE No. BFJ407). This Document has not been reviewed by the Hong Kong Securities and Futures Commission. It is not intended as an offer to sell securities or a solicitation to buy any product managed or provided by Equities First Holdings Hong Kong Limited and is only intended for persons who qualify as Professional Investors under the SFO. This document is not directed to individuals or organizations for whom such offers or invitations would be unlawful or prohibited.

Korea: The foregoing is intended solely for sophisticated investors, professional investors or otherwise qualified investors who have sufficient knowledge and experience in entering into securities financing transactions. It is not intended for, and should not be used by, persons who do not meet those criteria.

United Kingdom: Equities First (London) Limited is authorised and regulated in the UK by the Financial Conduct Authority (“FCA”). In the UK, this Document is only being distributed and made available to persons of the kind described in Article 19(5) (investment professionals) and Article 49(2) (high net worth companies, unincorporated associations etc.) of Part IV of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (‘’FPO’’) and any investment activity to which this presentation relates is only available to, and will only be engaged in with, such persons. Persons who do not have professional experience in matters relating to investment or who are not persons to whom Article 49 of the FPO applies should not rely on this document. This Document is only prepared for and available to persons who qualify as Professional Investors under the Markets in Financial Instruments Directive.