Private markets are pivotal to the energy transition

Private markets, not public ones, are driving the overwhelming majority of investment in solutions needed to combat the climate crisis.

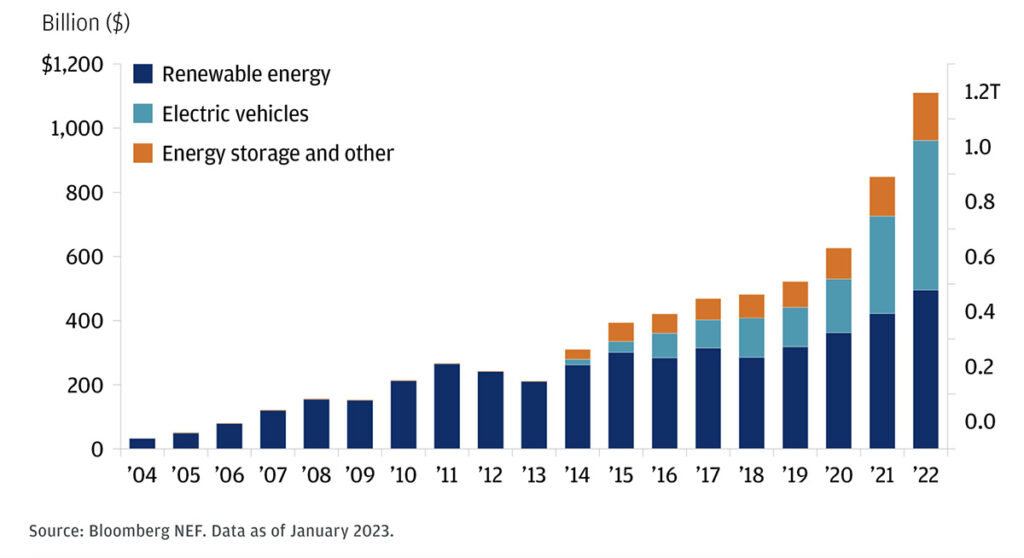

According to BloombergNEF, new investment in the renewable energy sector globally rose 13% in 2022 to $532 billion.[1] Private debt and investment accounted for 93% of the total, in the form of asset finance and small-scale solar projects. Investment in public markets accounted for just 3.3% of the total.[2]

Put simply, private markets offer the most direct and effective route for investors wishing to pursue greenfield opportunities in the renewables sector and contribute meaningfully to curtailing greenhouse gas emissions.

Private markets are also playing a crucial role in funding early-stage ventures working on climate solutions, allowing investors to get close to the action in projects that could help safeguard our future, but also offer solid long-term return potential.

Scenario analysis by the International Energy Agency concludes that in order to achieve net zero globally by 2050, nearly half of all emissions savings would need to come from technologies that have yet to be commercially deployed. Many of these technologies are being developed by companies that are categorised as startups—in other words, they are not publicly listed and have yet to achieve profitability. Their main source of funding is private equity and debt.

Image source: https://privatebank.jpmorgan.com/gl/en/insights/investing/the-energy-transition-is-ramping-up-investors-should-take-note

An immense opportunity

Given the transition to clean energy is estimated to require between $119 trillion and $194 trillion by 2050,[3] private markets will need to step up even further to meet the pressing climate investment need.

Private debt in particular is rushing in to fill the gap. Leading alternative investment manager Blackstone recently closed the biggest ever energy transition private debt fund at over $7 billion.[4] BlackRock has also acquired Kreos Capital, one of Europe’s largest loan providers to startups and high growth companies.[5]

Then there is global investment firm KKR & Co’s move to buy $550 million worth of solar energy loans extended to the customersof US-based startup SunPower Corp., which offers a solution to make it easier for homeowners to install solar energy solutions without having to bear the high up-front costs.[6]

And Ares Management Corp. and Copenhagen Infrastructure Partners have recently launched large private debt funds targeting the renewables sector.

What’s more, S&P Global reports that private debt providers are also working with banks on renewable energy project financing deals. These include big hydrogen projects on the US Gulf Coast, which have struggled to access financing as banks scale back lending. Private debt has come in to take on some of the risks traditional institutions are unwilling to bear in the current market environment—by doing so, the projects become bankable enough to also attract additional funds from mainstream lenders, allowing them to get off the ground.[7]

Riding renewables tailwinds with securities-based financing

These various private market investments targeting the energy transition stand to benefit from two critical tailwinds.

First, the economic fundamentals of renewable energy technologies continue improving rapidly. Solar and wind power is already cheaper than fossil fuels in many parts of the world, and their continued cost decline is set to make transformational technologies like green hydrogen increasingly viable.

And second, as the consequences of climate change become more visible and pronounced, major governments are likely to introduce more stringent regulations and more generous incentives designed to hasten the transition to greener energy sources. The US Inflation Reduction Act, for example, announced last year by President Biden, will provide substantial incentives for electric carmakers and other renewable energy companies over the next decade.

Individuals can also access innovative forms of private debt to access financing for small-scale renewable energy installations—through which they can collectively make a sizeable contribution to mitigating climate change. In a nod to SunPower’s playbook, homeowners and businesses could, for example, use securities-based financing from EquitiesFirst to install rooftop solar systems, which could lead to emissions reductions as well as savings on their energy bills.

More broadly, securities-based financing can provide a convenient and flexible way for long-term investors to use their equities or crypto as collateral to access liquidity to pursue a bewildering array of emerging opportunities related to the energy transition without having to sacrifice upside potential from their existing holdings.

Among these opportunities, it is worth highlighting that overall investment in electric vehicles last year was pretty much on par with investment in renewable energy. And energy storage appears to be an especially fast-growing investment segment, given one of the biggest remaining impediments to the widespread use of renewable energy is the difficulty of storing it.

Indeed, the energy transition is a critical theme that not only extends to practically every sector of the economy, but also enjoys a uniquely favourable regulatory and market climate. At a time when traditional lenders are wary of financing even such projects, securities-based financing provides a compelling means of keeping the transition moving forward.

[1] https://about.bnef.com/new-energy-outlook-series/

[2] https://www.alliancebernstein.com/n-europe/en-gb/institutions/insights/investment-insights/how-private-assets-can-empower-the-energy-transition.html

[3] https://about.bnef.com/new-energy-outlook-series/

[4] https://www.blackstone.com/news/press/blackstone-closes-record-energy-transition-private-credit-fund-at-over-7-billion/

[5] https://www.blackrock.com/corporate/newsroom/press-releases/article/corporate-one/press-releases/blackrock-to-acquire-kreos-capital

[6] https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/private-credit-eyes-renewable-energy-ops-permira-direct-lending-fund-hits-8364-4-2b-76171377

[7] https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/private-credit-eyes-renewable-energy-ops-permira-direct-lending-fund-hits-8364-4-2b-76171377

Disclaimer

Past performance does not guarantee future returns, and individual returns are not guaranteed or warranted.

This Document is intended solely for accredited investors, sophisticated investors, professional investors, or otherwise qualified investors, as may be required by law or otherwise, and it is not intended for, and should not be used by, persons who do not meet the relevant requirements. The content provided herein is for informational purposes only and is general in nature and not targeted to any specific objective or financial need. The views and opinions expressed in this Document have been prepared by third parties and do not necessarily reflect the views and opinions of EquitiesFirst. EquitiesFirst has not independently examined or verified the information provided herein, and no representation is made that it is accurate or complete. Opinions and information herein are subject to change without notice. The content provided does not constitute an offer to sell (or solicitation of an offer to purchase) any securities, investments, or any financial products (“Offer”). Any such Offer shall only be made through a relevant offering or other documentation which sets forth its material terms and conditions. Nothing contained in this Document shall constitute a recommendation, solicitation, invitation, inducement, promotion, or offer for the purchase or sale of any investment product by Equities First Holdings, LLC or its subsidiaries (collectively, “EquitiesFirst”), nor shall this Document be construed in any way as investment, legal, or tax advice, or as a recommendation, reference, or endorsement by EquitiesFirst. You should seek independent financial advice prior to making an investment decision about a financial product.

This Document contains the intellectual property of EquitiesFirst in the United States and other countries, including, without limitation, their respective logos and other registered and unregistered trademarks and service marks. EquitiesFirst reserves all rights in and to their intellectual property contained in this Document. The Document should not be distributed, published, reproduced or otherwise made available in whole or in part by recipients to any other person and, in particular, should not be distributed to persons in any country where such distribution may lead to a breach of any legal or regulatory requirement.

EquitiesFirst make no representation or warranty with respect to this Document and expressly disclaim any implied warranty under law. You acknowledge that EquitiesFirst is not liable under any circumstances for any direct, indirect, special, consequential, incidental, or punitive damages whatsoever, including, without limitation, any lost profits or lost opportunity, even if EquitiesFirst has been advised of the possibility of such damages.

EquitiesFirst makes the following further statements that may be applicable in the stated jurisdiction:

Australia: Equities First Holdings (Australia) Pty Ltd (ACN: 142 644 399) holds an Australian Financial Services Licence (AFSL Number: 387079). All rights reserved.

The information contained on this Document is intended for persons located in Australia only and classified as a Wholesale Client only as defined in Section 761G of the Corporations Act 2001. The distribution of information to persons outside this criteria may be restricted by law and persons who come into possession of it should seek advice and observe any such restriction.

The material contained in this Document is for information purposes only and should not be construed as an offer or solicitation or recommendation to buy or sell financial products.

The information contained in this Document is intended to be general in nature and is not personal financial product advice. Any advice contained in the Document is general advice only and has been prepared without considering your objectives, financial situation or needs. Before acting on any information, you should consider the appropriateness of the information provided and the nature of the relevant financial product having regard to your objectives, financial situation and needs. You should seek independent financial advice and read the relevant disclosure statements or other offer documents prior to making an investment decision about a financial product.

Dubai: Equities First Holdings Hong Kong Ltd (DIFC Representative Office) at Gate Precinct Building 4, 6th Floor, Office 7, Dubai International Financial Centre (commercial license number CL7354) is regulated by the Dubai Financial Services Authority (“DFSA”) as a Representative Office (DFSA Firm Reference No.: F008752). All rights reserved.

The information contained in this document is intended to be general in nature, and, to the extent that it is perceived as advice, any advice contained in this document is general advice only and has been prepared without considering your objectives, financial situation, suitability of the financial products or your needs.

The material contained in this document is for information purposes only and should not be construed as financial advice, including an offer or solicitation or recommendation to buy or sell financial products. The information contained in this document is intended to be general in nature and any advice contained in this document is general advice only and has been prepared without considering your objectives, financial situation, suitability of the financial products or your needs. Before acting on any information, you should consider the appropriateness of the information provided and the nature of the relevant financial product having regard to your objectives, financial situation and needs. If you do not understand the contents of this document, you should consult an authorised financial adviser.

This document relates to a financial product which is not subject to any form of regulation or approval by the DFSA. The DFSA has no responsibility for reviewing or verifying any documents in connection with this financial product. Accordingly, the DFSA has not approved this document or any other associated documents nor taken any steps to verify the information set out in this document, and has no responsibility for it.

Hong Kong: Equities First Holdings Hong Kong Limited is licensed under the Money Lenders Ordinance (Money Lender’s Licence No. 1659/2024) and to carry on the business of dealing in securities (Type 1 licence) under the Securities and Futures Ordinance (“SFO”) (CE No. BFJ407). This Document has not been reviewed by the Hong Kong Securities and Futures Commission. It is not intended as an offer to sell securities or a solicitation to buy any product managed or provided by Equities First Holdings Hong Kong Limited and is only intended for persons who qualify as Professional Investors under the SFO. This document is not directed to individuals or organizations for whom such offers or invitations would be unlawful or prohibited.

Korea: The foregoing is intended solely for sophisticated investors, professional investors or otherwise qualified investors who have sufficient knowledge and experience in entering into securities financing transactions. It is not intended for, and should not be used by, persons who do not meet those criteria.

United Kingdom: Equities First (London) Limited is authorised and regulated in the UK by the Financial Conduct Authority (“FCA”). In the UK, this Document is only being distributed and made available to persons of the kind described in Article 19(5) (investment professionals) and Article 49(2) (high net worth companies, unincorporated associations etc.) of Part IV of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (‘’FPO’’) and any investment activity to which this presentation relates is only available to, and will only be engaged in with, such persons. Persons who do not have professional experience in matters relating to investment or who are not persons to whom Article 49 of the FPO applies should not rely on this document. This Document is only prepared for and available to persons who qualify as Professional Investors under the Markets in Financial Instruments Directive.