Why investors see better returns from going more global

Home bias – investors’ tendency to buy assets in places they are familiar with – has a lot to answer for.

It is natural and understandable that people are generally more comfortable buying what they know – or think they know. But by doing so they can miss out on significant opportunities or, worse, suffer bigger losses because of insufficient geographic diversification.

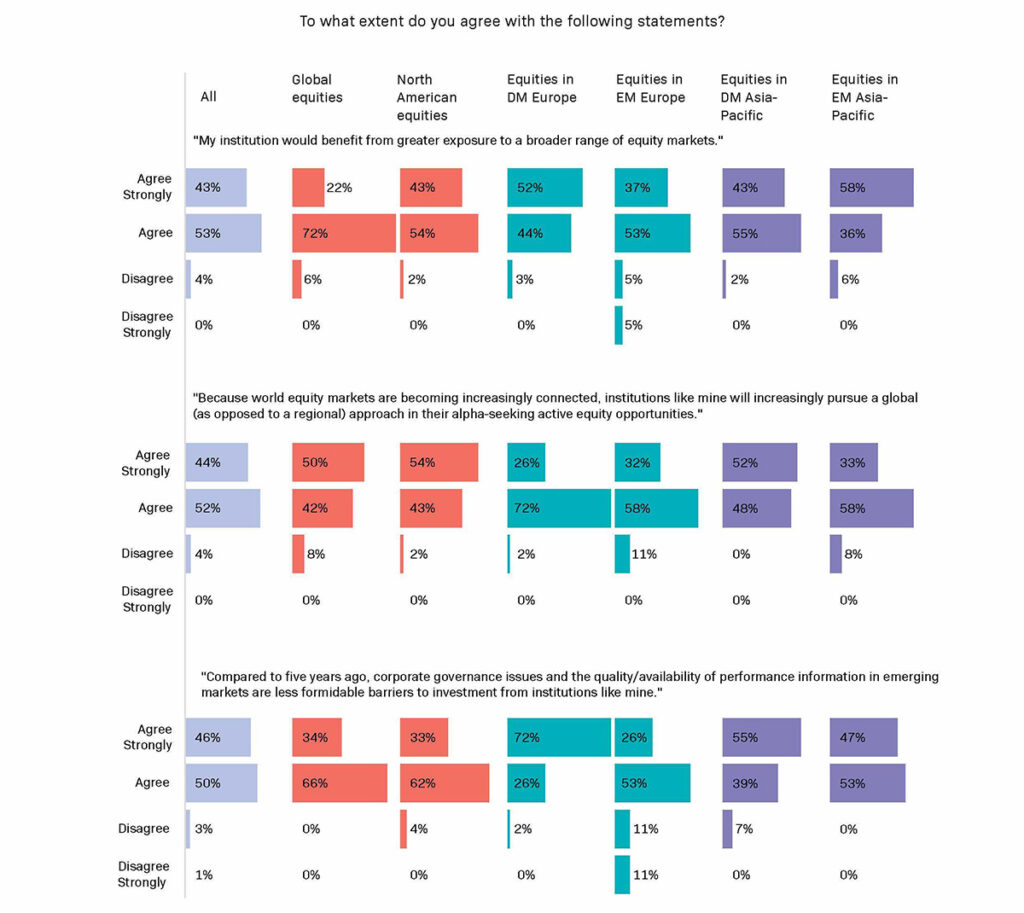

That is why smart investors are generally diversified across different asset classes and countries. A recent international survey by EquitiesFirst in collaboration with Institutional Investor’s Custom Research Lab, revealed near-universal agreement among some 300 investment decision-makers that their financial institutions would benefit from exposure to a broader range of equity markets.

According to the study, the overriding rationale for taking a global approach to buying active, alpha-seeking equity opportunities is that equity markets are becoming ever more interconnected. Global diversification can help reduce the concentration risk of investing in one region, potentially helping to smooth out portfolio volatility.

Upside potential

It can also encourage investors to pay more attention to emerging markets, which attract far less capital than developed ones despite offering much greater upside potential, especially over the long term.

While emerging countries now account for about 40% of global GDP and have been responsible for almost two-thirds of global growth over the past two decades,[1] their stock markets account for just a quarter of the world’s market capitalization.[2] That narrowed for much of the past decade, when emerging market equities outperformed those of developing countries, except in 2022, when owing largely to lockdowns in China, they underperformed.[3]

With China’s abrupt reopening coming earlier than expected in late 2022, emerging country equity benchmarks look set to rebound strongly this year on the back of improved near-term prospects and long-term demographic trends. Even with high interest rates and the Ukraine war dragging on global markets, emerging-country GDP growth rate will hit 3.9% in 2023, around the same rate as last year, largely driven by developing Asia, predicts the IMF. For advanced economies, meanwhile, the figure will plunge to 1.3% from 2.7% in 2022.[4]

On challenging ground

Of course, broad measures like GDP growth and global emerging equity indices mask the large and diverse challenges that Asia and other developing markets pose investors.

Compared to developed economies, emerging markets are typically less economically and politically stable, have lower standards of governance and are generally less liquid and transparent and harder to access.[5] And within the emerging market universe, countries are far from homogeneous, with hugely varying growth rates, political systems and corporate landscapes – hence the opportunities and risks they present diverge widely.

For much the same reasons, however, emerging market stocks have the potential to generate big returns for savvy, well-informed and selective investors.

Emerging countries’ standards of corporate reporting, auditing and governance may lag those of developed markets, but the situation is improving. Corporate governance issues and the quality and availability of performance data have become less formidable barriers to investing in emerging markets, agreed almost all respondents to the Equities First survey.

Several investment decision-makers interviewed for the study also stressed that further improvements are likely in the coming years, with emerging markets appearing on more investors’ radars and competition for international capital heating up. If companies in emerging markets wish to attract foreign investors, they will have to improve their transparency, reporting and compliance.

Emerging tailwinds

There is good reason to expect emerging markets in four key categories to perform strongly for the foreseeable future, say analysts at investment bank Morgan Stanley.[6]

For one thing, certain countries are set to prosper from their growth as manufacturing hubs. They are largely concentrated in Southeast Asia and Eastern Europe, with Vietnam and Poland standing out as notable examples.[7]

Some nations, meanwhile, have received an economic boost from the revival in commodity prices and have a critical role to play in supplying the metals and minerals necessary for the energy transition – the likes of Brazil, Chile, Indonesia and Russia.[8]

A third category identified by Morgan Stanley contains developing countries that were forced to undertake painful economic reforms during the Covid pandemic but, as a result, are now set to grow more sustainably in coming years. These include India and Indonesia.[9]

Finally, certain markets seem especially well placed to benefit from accelerating digital transformation – again, fuelled by coronavirus lockdowns – and with the potential to create local versions of US and Chinese tech giants. This trend looks set to have a particular impact across Latin America, East Asia and Africa.[10]

For now, assets in many of these countries appear cheap compared to those in developed markets. Indeed many investors argue that emerging market stocks are heavily mispriced and under-owned – even taking into account the higher risks they entail – and that current valuations could be some of the most attractive ever.[11]

Investors in need of capital to pursue such opportunities may wish to consider securities-backed financing. By using equities or crypto as collateral, they can access funding to diversify their portfolios with greater exposure to new markets, without having to downsize positions in their home markets.

They could miss out on big return opportunities if they do not.

[1] https://www.gbm.hsbc.com/en-gb/campaigns/accessing-emerging-markets#:~:text=Over%20the%20last%2020%20years,of%20the%20world’s%20GDP%20growth.

[2] https://www.morganstanley.com/im/publication/insights/articles/article_howmuchtoown_us.pdf

[3] https://www.ftadviser.com/investments/2023/02/06/why-emerging-markets-are-an-attractive-opportunity/

[4] https://www.imf.org/en/Publications/WEO/Issues/2023/04/11/world-economic-outlook-april-2023

[5] https://www.ftadviser.com/investments/2023/02/06/why-emerging-markets-are-an-attractive-opportunity/

[6] https://www.morganstanley.com/im/publication/insights/articles/article_howmuchtoown_us.pdf

[7] https://www.morganstanley.com/im/publication/insights/articles/article_howmuchtoown_us.pdf

[8] https://www.morganstanley.com/im/publication/insights/articles/article_howmuchtoown_us.pdf

[9] https://www.morganstanley.com/im/publication/insights/articles/article_howmuchtoown_us.pdf

[10] https://www.morganstanley.com/im/publication/insights/articles/article_howmuchtoown_us.pdf

[11] https://www.lazardassetmanagement.com/hk/en_us/research-insights/outlooks/emerging-markets

Disclaimer

Past performance does not guarantee future returns, and individual returns are not guaranteed or warranted.

This Document is intended solely for accredited investors, sophisticated investors, professional investors, or otherwise qualified investors, as may be required by law or otherwise, and it is not intended for, and should not be used by, persons who do not meet the relevant requirements. The content provided herein is for informational purposes only and is general in nature and not targeted to any specific objective or financial need. The views and opinions expressed in this Document have been prepared by third parties and do not necessarily reflect the views and opinions of EquitiesFirst. EquitiesFirst has not independently examined or verified the information provided herein, and no representation is made that it is accurate or complete. Opinions and information herein are subject to change without notice. The content provided does not constitute an offer to sell (or solicitation of an offer to purchase) any securities, investments, or any financial products (“Offer”). Any such Offer shall only be made through a relevant offering or other documentation which sets forth its material terms and conditions. Nothing contained in this Document shall constitute a recommendation, solicitation, invitation, inducement, promotion, or offer for the purchase or sale of any investment product by First Holdings, LLC or its subsidiaries (collectively, “EquitiesFirst”), nor shall this Document be construed in any way as investment, legal, or tax advice, or as a recommendation, reference, or endorsement by EquitiesFirst. You should seek independent financial advice prior to making an investment decision about a financial product.

This Document contains the intellectual property of EquitiesFirst in the United States and other countries, including, without limitation, their respective logos and other registered and unregistered trademarks and service marks. EquitiesFirst reserves all rights in and to their intellectual property contained in this Document. The Document should not be distributed, published, reproduced or otherwise made available in whole or in part by recipients to any other person and, in particular, should not be distributed to persons in any country where such distribution may lead to a breach of any legal or regulatory requirement.

EquitiesFirst make no representation or warranty with respect to this Document and expressly disclaim any implied warranty under law. You acknowledge that EquitiesFirst is not liable under any circumstances for any direct, indirect, special, consequential, incidental, or punitive damages whatsoever, including, without limitation, any lost profits or lost opportunity, even if EquitiesFirst has been advised of the possibility of such damages.

EquitiesFirst makes the following further statements that may be applicable in the stated jurisdiction:

Australia: Equities First Holdings (Australia) Pty Ltd (ACN: 142 644 399) holds an Australian Financial Services Licence (AFSL Number: 387079). All rights reserved.

The information contained on this Document is intended for persons located in Australia only and classified as a Wholesale Client only as defined in Section 761G of the Corporations Act 2001. The distribution of information to persons outside this criteria may be restricted by law and persons who come into possession of it should seek advice and observe any such restriction.

The material contained in this Document is for information purposes only and should not be construed as an offer or solicitation or recommendation to buy or sell financial products.

The information contained in this Document is intended to be general in nature and is not personal financial product advice. Any advice contained in the Document is general advice only and has been prepared without considering your objectives, financial situation or needs. Before acting on any information, you should consider the appropriateness of the information provided and the nature of the relevant financial product having regard to your objectives, financial situation and needs. You should seek independent financial advice and read the relevant disclosure statements or other offer documents prior to making an investment decision about a financial product.

Hong Kong: Equities First Holdings Hong Kong Limited is licensed under the Money Lenders Ordinance (Money Lender’s Licence No. 1681/2023) and to carry on the business of dealing in securities (Type 1 licence) under the Securities and Futures Ordinance (“SFO”) (CE No. BFJ407). This Document has not been reviewed by the Hong Kong Securities and Futures Commission. It is not intended as an offer to sell securities or a solicitation to buy any product managed or provided by Equities First Holdings Hong Kong Limited and is only intended for persons who qualify as Professional Investors under the SFO. This document is not directed to individuals or organizations for whom such offers or invitations would be unlawful or prohibited.

Korea: The foregoing is intended solely for sophisticated investors, professional investors or otherwise qualified investors who have sufficient knowledge and experience in entering into securities financing transactions. It is not intended for, and should not be used by, persons who do not meet those criteria.

United Kingdom: Equities First (London) Limited is authorised and regulated in the UK by the Financial Conduct Authority (“FCA”). In the UK, this Document is only being distributed and made available to persons of the kind described in Article 19(5) (investment professionals) and Article 49(2) (high net worth companies, unincorporated associations etc.) of Part IV of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (‘’FPO’’) and any investment activity to which this presentation relates is only available to, and will only be engaged in with, such persons. Persons who do not have professional experience in matters relating to investment or who are not persons to whom Article 49 of the FPO applies should not rely on this document. This Document is only prepared for and available to persons who qualify as Professional Investors under the Markets in Financial Instruments Directive.