Volatile markets spark a revival of active investing

It’s been a turbulent 18 months, to put it mildly.

Market volatility, as measured by the VIX Index, has seen huge spikes since the start of 2022, and for good reason. There has been Russia’s invasion of Ukraine in February 2022 and the UK’s swiftly reversed mini-budget in September, not to mention soaring inflation, subsequent rapid interest rate hikes, heightened geopolitical tensions and frequent rounds of sanctions, led by the US and China.

All these unknowns create considerable risks to economic growth, day-to-day commercial operations and the value of financial assets.

So it is hardly surprising that markets are on edge. Despite a period of relative calm in June, when the VIX – often known as the ‘fear gauge’ – fell to its lowest levels for over three years, investors are expecting volatility to rise again.

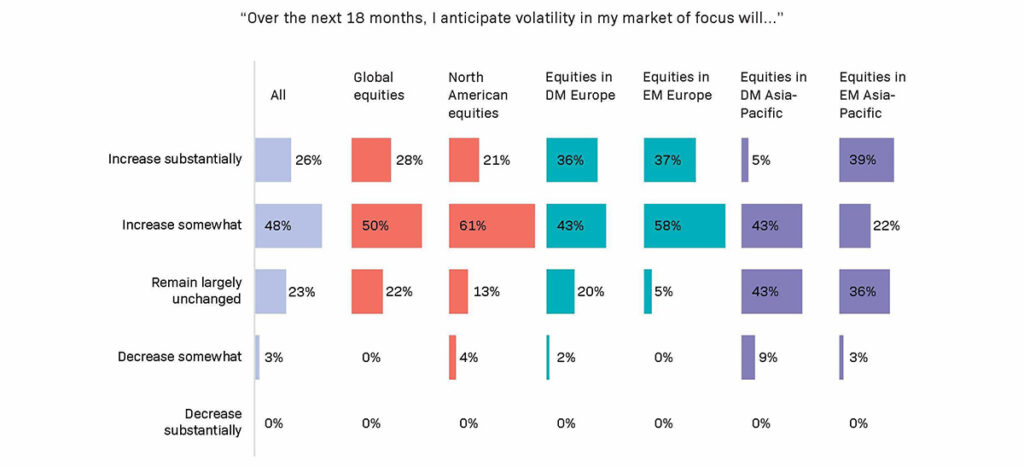

Nearly three-quarters of those surveyed for a wide-ranging study by EquitiesFirst in collaboration with Institutional Investor’s Custom Research Lab said volatility would increase in their market of focus. The report gauges the outlook for global equity markets of some 300 investment decision-makers at a wide range of asset managers, foundations, pension funds and endowments.

Volatility creates opportunity

Of course, savvy investors can benefit from volatile markets – by being greedy when others are fearful, to paraphrase Warren Buffett. Survey respondents most commonly expected volatility increases to come in Asia-Pacific and European emerging markets, which suggests there will be opportunities for those brave enough to take them.

Emerging markets are typically less transparent and less liquid – and therefore more often mispriced – than their developed peers, a situation further exacerbated by volatility. Under such circumstances, active investment strategies can prove especially effective. Indeed, active managers have long argued that they perform best during volatile times.[1]

Sure enough, active managers experienced increased inflows in the first quarter of 2023 on the back of growing interest in emerging market and credit strategies, according to Investment Metrics.[2]

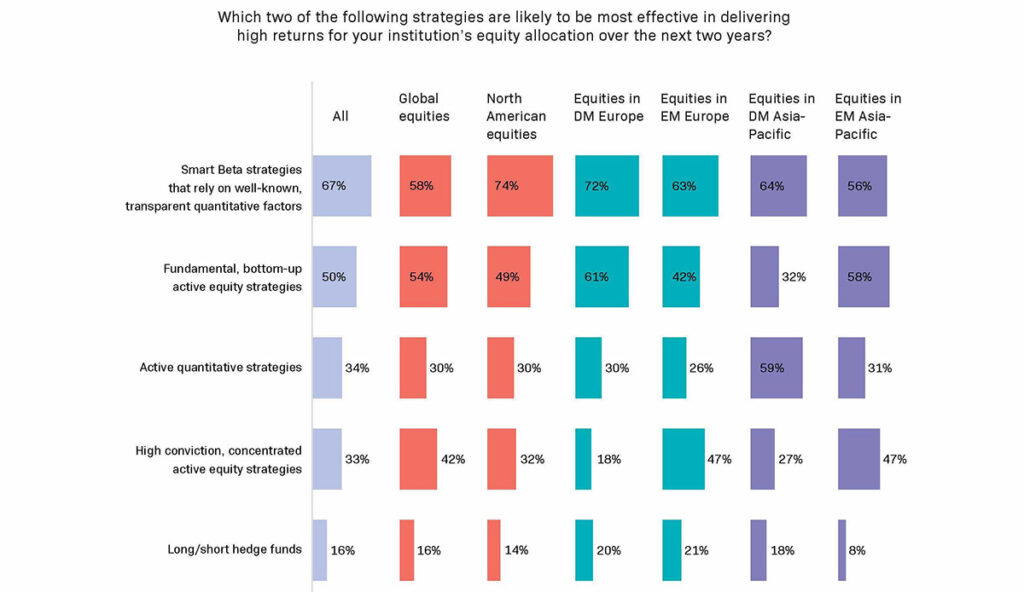

The EquitiesFirst x Institutional Investor study reflected this thinking, with respondents taking the view that concentrated high-conviction strategies will be more effective in emerging Europe and Asia Pacific markets than in developed ones.

Growth preferred to value

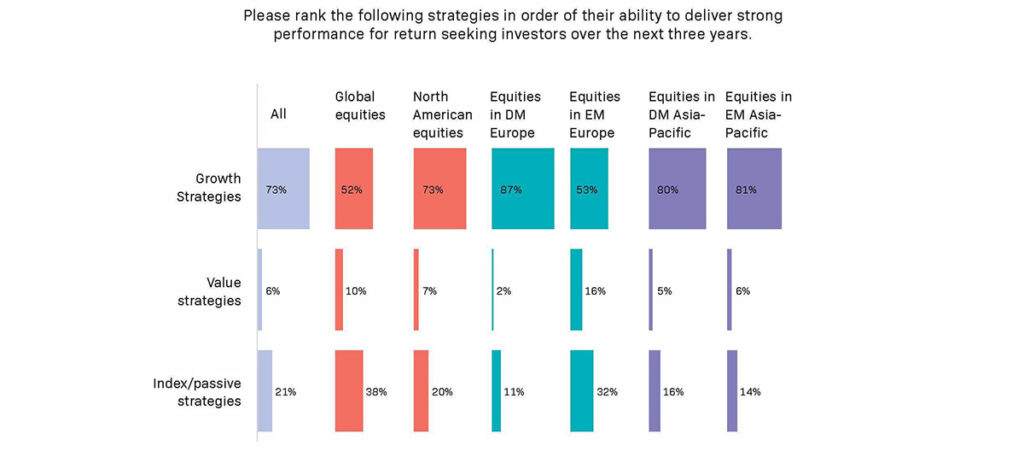

The study also shows a strong preference among investment-decision makers for growth over value investing. The former typically buys high-quality stocks that have the potential to deliver above-average growth, while the latter targets aims to purchase under-performing companies before their operating results and market performance turn more positive.

Strong support for growth over value strategies

The current preference for growth strategies may well be tied to a belief that we are heading into a period of sustained economic growth, with the emergence of new high-growth companies or offerings from well-established innovators that are well positioned to prosper under such conditions.

By contrast, value strategies are more likely to thrive during periods of moderate economic growth and low capital costs, when high growth opportunities are often elusive and index strategies suffer from tepid growth and profitability.

As the study highlights, investors worry that since value stocks are often over-leveraged, they are particularly vulnerable to the present environment of high interest costs, low profitability and uneven cash flows. As such, many investors say they plan to rotate out of value equities into higher-growth, well-established high-tech and information-intensive companies.

There are several other strategies worth adopting in times of heightened volatility, including a focus on diversification, regular rebalancing of portfolios and staying abreast of market news. Informed and nimble investors have a better chance of outperforming the market.

Given the long list of current unknowns – including when inflation will ease, the direction of US Federal Reserve policy and how issues such as the Ukraine war and US-China trade relations will pan out – institutions need to be able to dynamically adjust their asset allocations.

Securities-backed financing can provide that flexibility. Investors can use their equities or crypto assets as collateral to fund quick moves into new positions and diversify their portfolios without having to sacrifice the upside potential of their holdings.

[1] https://www.institutionalinvestor.com/article/b1yz0rz06xjl4k/Active-Managers-Are-Proving-Their-Worth-Right-Now-Will-It-Last

[2] https://www.institutionalinvestor.com/article/b1yz0rz06xjl4k/Active-Managers-Are-Proving-Their-Worth-Right-Now-Will-It-Last

Disclaimer

Past performance does not guarantee future returns, and individual returns are not guaranteed or warranted.

This Document is intended solely for accredited investors, sophisticated investors, professional investors, or otherwise qualified investors, as may be required by law or otherwise, and it is not intended for, and should not be used by, persons who do not meet the relevant requirements. The content provided herein is for informational purposes only and is general in nature and not targeted to any specific objective or financial need. The views and opinions expressed in this Document have been prepared by third parties and do not necessarily reflect the views and opinions of EquitiesFirst. EquitiesFirst has not independently examined or verified the information provided herein, and no representation is made that it is accurate or complete. Opinions and information herein are subject to change without notice. The content provided does not constitute an offer to sell (or solicitation of an offer to purchase) any securities, investments, or any financial products (“Offer”). Any such Offer shall only be made through a relevant offering or other documentation which sets forth its material terms and conditions. Nothing contained in this Document shall constitute a recommendation, solicitation, invitation, inducement, promotion, or offer for the purchase or sale of any investment product by Equities First Holdings, LLC or its subsidiaries (collectively, “EquitiesFirst”), nor shall this Document be construed in any way as investment, legal, or tax advice, or as a recommendation, reference, or endorsement by EquitiesFirst. You should seek independent financial advice prior to making an investment decision about a financial product.

This Document contains the intellectual property of EquitiesFirst in the United States and other countries, including, without limitation, their respective logos and other registered and unregistered trademarks and service marks. EquitiesFirst reserves all rights in and to their intellectual property contained in this Document. The Document should not be distributed, published, reproduced or otherwise made available in whole or in part by recipients to any other person and, in particular, should not be distributed to persons in any country where such distribution may lead to a breach of any legal or regulatory requirement.

EquitiesFirst make no representation or warranty with respect to this Document and expressly disclaim any implied warranty under law. You acknowledge that EquitiesFirst is not liable under any circumstances for any direct, indirect, special, consequential, incidental, or punitive damages whatsoever, including, without limitation, any lost profits or lost opportunity, even if EquitiesFirst has been advised of the possibility of such damages.

EquitiesFirst makes the following further statements that may be applicable in the stated jurisdiction:

Australia: Equities First Holdings (Australia) Pty Ltd (ACN: 142 644 399) holds an Australian Financial Services Licence (AFSL Number: 387079). All rights reserved.

The information contained on this Document is intended for persons located in Australia only and classified as a Wholesale Client only as defined in Section 761G of the Corporations Act 2001. The distribution of information to persons outside this criteria may be restricted by law and persons who come into possession of it should seek advice and observe any such restriction.

The material contained in this Document is for information purposes only and should not be construed as an offer or solicitation or recommendation to buy or sell financial products.

The information contained in this Document is intended to be general in nature and is not personal financial product advice. Any advice contained in the Document is general advice only and has been prepared without considering your objectives, financial situation or needs. Before acting on any information, you should consider the appropriateness of the information provided and the nature of the relevant financial product having regard to your objectives, financial situation and needs. You should seek independent financial advice and read the relevant disclosure statements or other offer documents prior to making an investment decision about a financial product.

Dubai: Equities First Holdings Hong Kong Ltd (DIFC Representative Office) at Gate Precinct Building 4, 6th Floor, Office 7, Dubai International Financial Centre (commercial license number CL7354) is regulated by the Dubai Financial Services Authority (“DFSA”) as a Representative Office (DFSA Firm Reference No.: F008752). All rights reserved.

The information contained in this document is intended to be general in nature, and, to the extent that it is perceived as advice, any advice contained in this document is general advice only and has been prepared without considering your objectives, financial situation, suitability of the financial products or your needs.

The material contained in this document is for information purposes only and should not be construed as financial advice, including an offer or solicitation or recommendation to buy or sell financial products. The information contained in this document is intended to be general in nature and any advice contained in this document is general advice only and has been prepared without considering your objectives, financial situation, suitability of the financial products or your needs. Before acting on any information, you should consider the appropriateness of the information provided and the nature of the relevant financial product having regard to your objectives, financial situation and needs. If you do not understand the contents of this document, you should consult an authorised financial adviser.

This document relates to a financial product which is not subject to any form of regulation or approval by the DFSA. The DFSA has no responsibility for reviewing or verifying any documents in connection with this financial product. Accordingly, the DFSA has not approved this document or any other associated documents nor taken any steps to verify the information set out in this document, and has no responsibility for it.

Hong Kong: Equities First Holdings Hong Kong Limited is licensed under the Money Lenders Ordinance (Money Lender’s Licence No. 1659/2024) and to carry on the business of dealing in securities (Type 1 licence) under the Securities and Futures Ordinance (“SFO”) (CE No. BFJ407). This Document has not been reviewed by the Hong Kong Securities and Futures Commission. It is not intended as an offer to sell securities or a solicitation to buy any product managed or provided by Equities First Holdings Hong Kong Limited and is only intended for persons who qualify as Professional Investors under the SFO. This document is not directed to individuals or organizations for whom such offers or invitations would be unlawful or prohibited.

Korea: The foregoing is intended solely for sophisticated investors, professional investors or otherwise qualified investors who have sufficient knowledge and experience in entering into securities financing transactions. It is not intended for, and should not be used by, persons who do not meet those criteria.

United Kingdom: Equities First (London) Limited is authorised and regulated in the UK by the Financial Conduct Authority (“FCA”). In the UK, this Document is only being distributed and made available to persons of the kind described in Article 19(5) (investment professionals) and Article 49(2) (high net worth companies, unincorporated associations etc.) of Part IV of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (‘’FPO’’) and any investment activity to which this presentation relates is only available to, and will only be engaged in with, such persons. Persons who do not have professional experience in matters relating to investment or who are not persons to whom Article 49 of the FPO applies should not rely on this document. This Document is only prepared for and available to persons who qualify as Professional Investors under the Markets in Financial Instruments Directive.